With bonds, the issuer must pay interest to the investor. Do they produce enough profits for this?

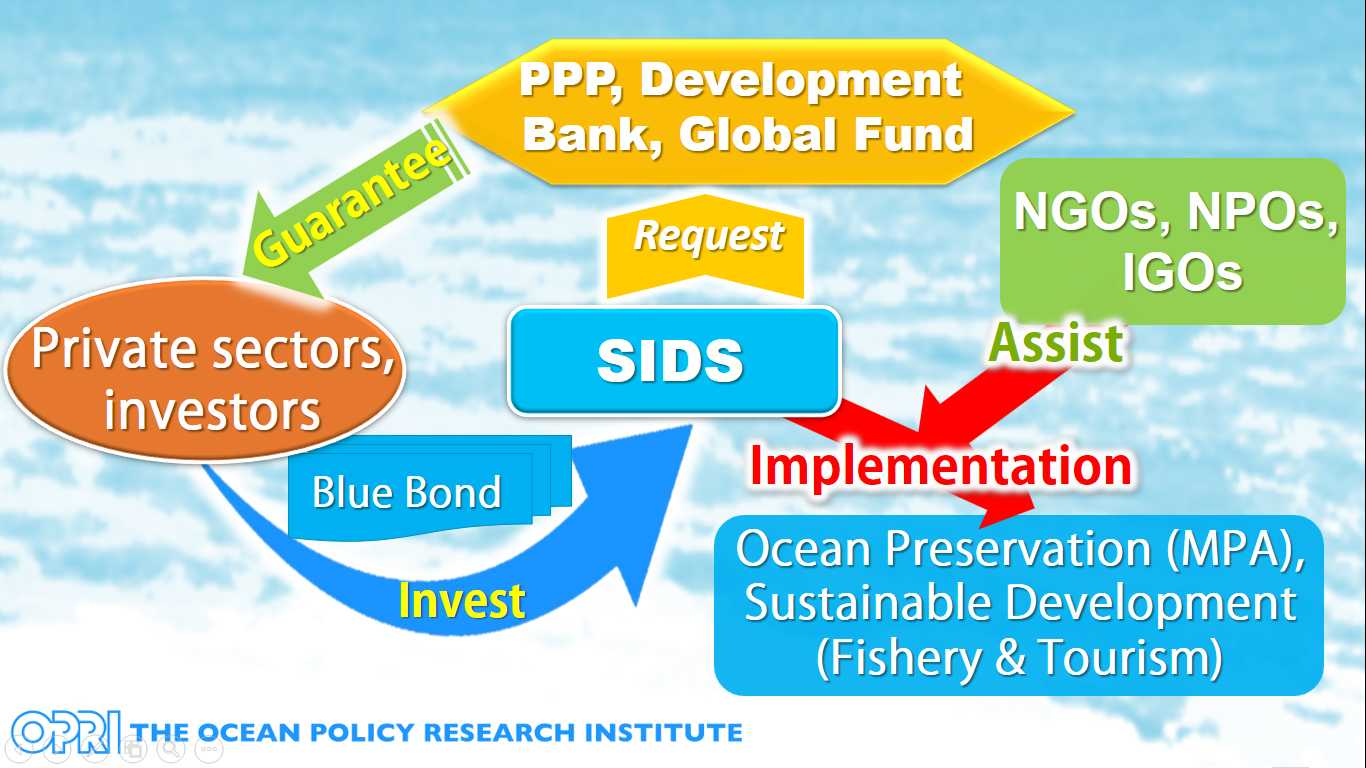

Dr. Huang: Let’s take the Blue Bonds issued by the Seychelles as an example. Their government has issued bonds for 15 million USD at 6.5% interest. Of this, the World Bank guaranteed the principal amount of 5 million dollars, and the Global Environment Facility (GEF), an international fund, financed 5 million USD for interest, fees, and so on. As this greatly reduced their default risk, it became easier for investors to buy the bonds.

How will the 15 million USD be used?

Dr. Huang: The plan is to use it to increase protected ocean zones, to fight IUU (Illegal, Unreported, Unregulated) fishing*2, and to promote the Blue Economy. This is expected to have effects such as reinvigorating the tourism industry.

*2. IUU fishing refers to illegal fishing such as poaching, unreported fishing such as falsifying the reporting of catches, and unregulated fishing that does not comply with national regulations or the regulations of the operating sea area.

Many island countries and coastal areas are economically dependent on fishing and other resources from the ocean, making them vulnerable to climate change and natural disaster risks. Alongside protecting oceanic resources, it is also important to promote disaster prevention and disaster mitigation, but governments may not have sufficient funds to do so, especially in developing countries. The Seychelles are calling for a larger number of organizations and people to collaborate in order to efficiently attract funds. At OPRI, we are trying to expand the reach of these collaboration-based Blue Bonds to the world at large.

What efforts are you making to achieve these objectives?

Dr. Huang: In order to issue Blue Bonds that can attract investors, the issuing country or region must collaborate with international organizations and development banks. OPRI is building a network to allow for collaboration with the World Bank, the Asian Development Bank Institute (ADBI), and more. Even internationally, research institutes specializing in the ocean on a global scale are rare, and there have been more and more calls for OPRI’s help.