Itsu Adachi, Executive Director at SPF, kicked off the session, introducing the "

Asia Women's Impact Fund (AWIF)" established by SPF to promote women's economic empowerment through GLI. He emphasized the idea that GLI is "not just the right investment, but the smart investment."

Next, Julia Enyart, Vice President of the Sustainable and Impact Investment Department at

Glenmede Investment Management, an independently owned boutique asset management company with USD 40 billion in assets under management, introduced a report that the firm released last year, entitled, "Gender Lens Investing in Public Markets: It's More Than Women at the Top.” In the report, Glenmede Investment Management explores the next frontier of GLI, with a focus on identifying five dimensions (women in leadership, access to benefits, pay equity, diverse supply chains, and talent and culture) that prove how investing in women pays off. Among its findings, she emphasized the correlation between gender equity and corporate performance, which showed that companies with gender-diverse leadership demonstrate lower risk and higher sales growth, EPS growth, and return on assets. In addition, she raised that there is a global trend among investors moving toward investment strategies that they pay attention not only in companies with many women in managerial positions, but also look at qualitative aspects, and that going forward, investors need to continue to pay more attention to more granular corporate features, including not just diversified leadership but also to these five dimensions to achieve social outcomes as well as financial outcomes.

Next, Patience Marime-Ball, Chief Executive Officer at the

Women of the World Endowment, stated that investing with gender lens by shifting financial systems to fully include them is our opportunity to build a sustainable future for humanity, and emphasized the importance of ESG investment (*) and gender impact investment, sharing cases on the effects of gender diversity on corporate performance as well as examples of private funds having good gender balance that outperformed their peers in annual returns. She also presented how Women of the World Endowment invests at the intersection of gender and other social issues with an aim to enable a positive impact in the lives of women, girls and their communities. She shared practical information on tools and platforms, such as Ethos, which provides scoring for investments on key impact areas such as gender equality, racial justice, climate change, etc. She also explained the opportunities in the Japanese market, using stocks, bonds, sovereigns and sub-sovereigns as examples.

*ESG investment: A type of investment that considers not just the financial information, but also the environmental (E), social (S), and governance (G) impacts in assessing returns.

In the last presentation, Seiichiro Uchi, Head of Self-Index and ESG Business Development Investment Solutions at

Invesco Asset Management (Japan) Limited, reviewed the situation of GLI in Japan. He first mentioned key milestones such as the selection of diversity-themed indices for ESG investment by the Government Pension Investment Fund (GPIF) in 2017 that provided momentum in advancing the concept of GLI, although the spread of GLI vehicles remains rather limited. Mr. Uchi explained how changes have been made in Japan through GLI since the GPIF's selection of diversity-themed indices for ESG investment in 2017, by showing several key data, such as how the number of companies with more than one female director increased from 40% to 72%. However, he said that in Japan, the proportion of women in managerial positions is still extremely low, and that companies without a comprehensive gender equity mandate may be exposed to unexpected risks and missed opportunities for long-term growth, and lack of gender equality and diversity is a systemic risk. Furthermore, in order to make changes, he mentioned it may also be necessary to utilize greater social power beyond the power of investment to solve such complex problems relating to the economy and society. Lastly, he mentioned the change that investors' interests are shifting from returns to returns + impacts, and emphasized that companies need to also move toward their ESG and impact purpose and enhance enterprise values.

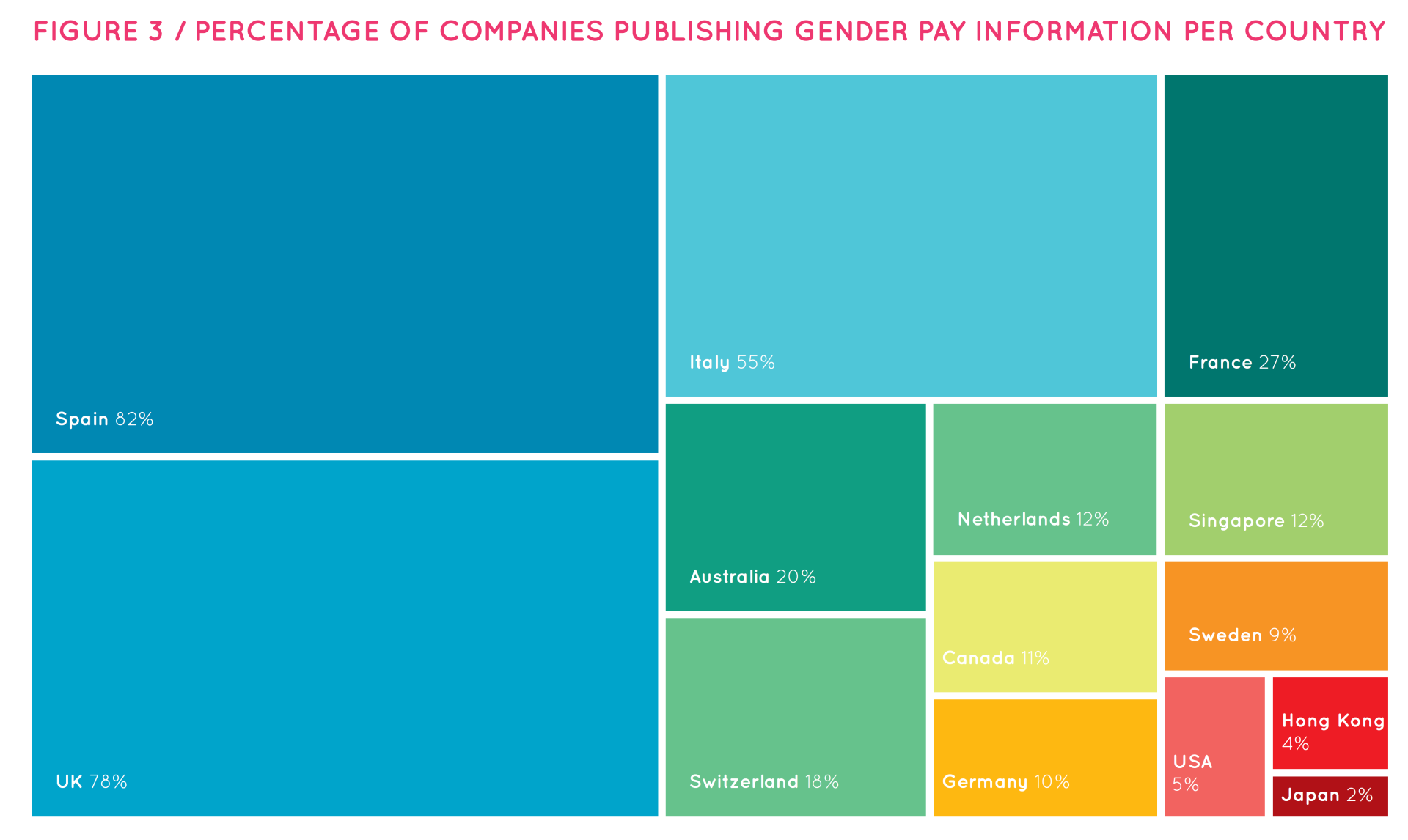

In the panel discussion session moderated by Mr. Adachi, Ms. Enyart first answered questions on how progress and changes have been made on quantitative information disclosure given the larger number of GLI vehicles in North America. She mentioned that women began to speak out problems such as sexual harassment in the workplace and various industries, and that the need to promote gender equality in the workplace became a common recognition, which helped to disclose important information which led to the creation of more GLI vehicles. In order to foster the field of GLI to mature more in the public market, she said that it is necessary for public companies to disclose data across the five dimensions of gender equity (women in leadership, access to benefits, pay equity, diverse supply chains, and talent and culture) by saying a more robust dataset may help identify factors for companies which can mitigate risk and drive long-term growth and progress toward true gender equity in the workplace. Regarding the hindrance of gender lens investment growth, she pointed out that data availability remains sparse, which is tied to the limited availability of GLI investment vehicles. (See figure below)