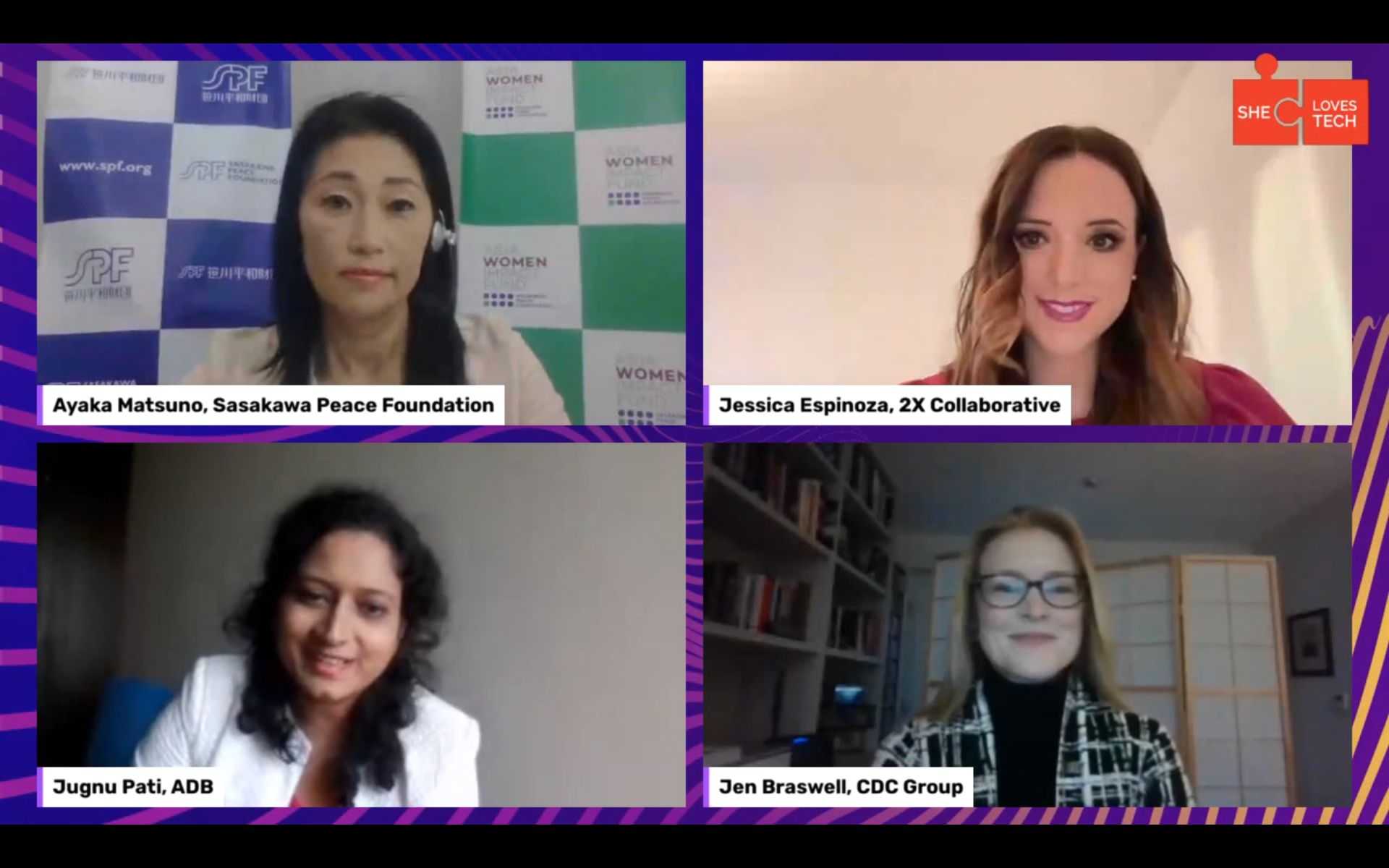

Ms. Pati began by noting that the 2X Challenge has committed a total of $7 billion between 2018 and 2020, more than doubling its goal of $3 billion, and has mobilized an additional $3 billion from private investors. She then asked Ms. Espinoza and Ms. Braswell to comment on the achievements of the 2X Challenge and the future prospects of the 2X Challenge.

Ms. Espinoza first explained how the 2X Challenge began in 2018, when industry standards for gender lens investing did not yet exist, so they began by focusing on women's entrepreneurship, women's leadership, quality employment, and products and services that substantially improve women's lives. She explained that they jointly developed the 2X Criteria, focusing on various areas along the value chain, such as products and services. These criteria have become the global industry standard for gender lens investing and are used today by many industry players beyond the members of the 2X Challenge and 2X Collaborative, she said.

In terms of future prospects, Ms. Espinoza said that the 2X Challenge could surpass the $15 billion mark by attracting private and institutional investors, and that the 2X Collaborative was established to promote the 2X Challenge. As a global association for gender lens investing, this organization plans to involve pension funds, family offices, foundations, and insurance companies. In addition, they would like to explore new types of investments, such as gender and environmental opportunities and investments in the care economy.

Looking ahead, Ms. Braswell described the 2X Challenge's new initiative, 2X Ignite. This initiative seeks to move capital into areas where it is not moving as fast as it should or could, and to enter sectors of the economy where it has not been possible to invest in the past by facilitating fund formation and other forms of origination. She also revealed her plans to work with the management team to transform the business to enable women to take on leadership roles, to use various networks and experts to recruit board members, and to design products and services for women, while keeping an eye on their portfolio to identify opportunities and investments coming into the pipeline.

Ms. Pati then asked Ms. Matsuno about the SPF’s gender lens investing initiatives.

Ms. Matsuno noted that Japan is also contributing to the 2X Challenge through JICA and JBIC, and that SPF is playing a role in mobilizing private funding in Japan.

As a specific example, she introduced the

Asia Women Impact Fund (AWIF), which the foundation launched in 2017. Through AWIF,

SPF has invested USD 30 million in the Japan ASEAN Women Empowerment Fund (JAWEF), which provides funding to microfinance institutions that support women's empowerment in ASEAN and other parts of Asia. Ms. Matsuno also explained that although SPF is not directly investing in women entrepreneurs, the foundation supports gender-smart entrepreneurial ecosystem building in Southeast Asia through technical assistance projects.