So, what have we learnt from this study?

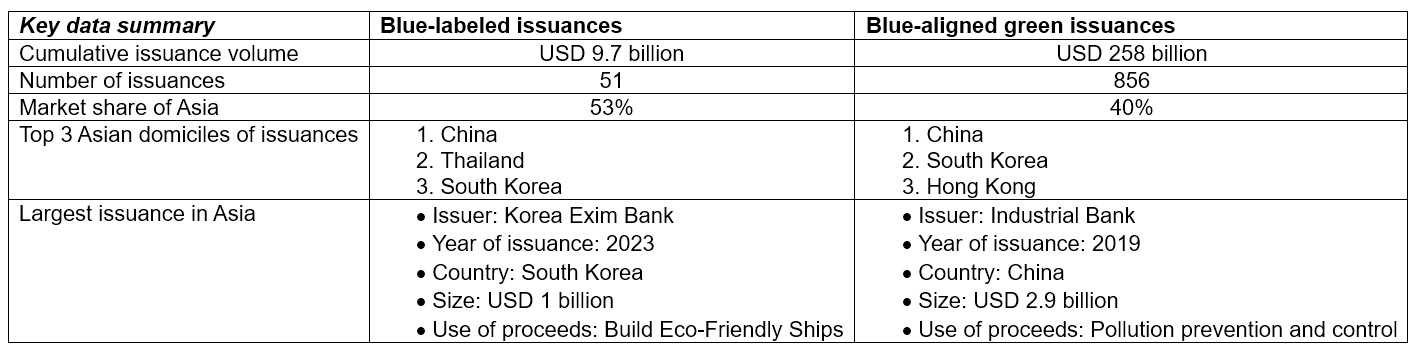

Since the inaugural sovereign blue bond in 2018, blue finance debt instruments have gained traction today, culminating at over 50 issuances and nearly USD 10 billion of capital raised to finance sectors of the blue economy across the globe in a wide range of projects related to blue infrastructure, ocean conservation, circular economy, sustainable ports, and shipping, to name a few. Asia's contribution to this market is notable, with over 50% of volumes originating from the region.

The region's surge in blue issuances has emanated from sovereigns, banks, corporations, and development financial institutions (DFIs). Sovereigns and DFIs, as vanguards of the blue finance movement, have assumed roles as advisors and investors in blue bonds and blue loans. But capital has also flowed from private institutional channels such as banks, impact asset managers, and insurance companies, further solidifying the foundation of blue-themed financial instruments.

While blue-labeled instruments are still building their track record, our study unveils the potential for scaling up blue finance to levels witnessed by the green bond market. As such, the financing of projects within the blue economy has been embedded in green bond and loan issuances historically – a segment of the market we identify as “blue-aligned green bonds” in our study. Thanks to historical data and context of green debt issuances, we estimate that USD 258 billion of green issuances (856 in number) have been used to finance blue sectors and use of proceeds since 2007 worldwide.

This demonstrates a strong link between novel debt issuances labeled as blue and the more established green financing market. Benefiting from more than a decade of green issuance has set the stage for market expectations and convergence of blue financing around the debt issuance process, allocation and management of proceeds, and impact reporting. While the definition of what constitutes blue in terms of eligibility criteria and impact is still being debated in the market today, emerging blue frameworks such as those developed by the

International Finance Corporation (IFC) and the

Asian Development Bank (ADB) are a handy starting point to calibrate blue investments against their green counterparts.