Introduction

On August 6, 2025, President Donald J. Trump of the United States signed an Executive Order imposing secondary tariffs on India, thereby raising the total tariff rate to 50%, in response to India’s continued procurement of Russian crude oil.[1] Since the invasion of Ukraine by Russia in February 2022, India has actively purchased Russian crude oil and has not only used it to meet domestic demand but has also refined it and exported it to regions around the world as Indian petroleum products. Attention is being focused on whether India, as it faces stronger pressure from the Trump administration, will scale back its energy relationship with Russia going forward. In this paper, we discuss the reasons why India is procuring Russian crude oil and India’s role as a “petroleum products supplier.”

India wants Russian crude oil

Amid the ongoing Ukraine war, India has expanded its imports of crude oil from Russia. The background to this is that Russian crude oil became cheaper due to the sanctions imposed by the Western countries. The European Union (EU) strengthened sanctions on Russia in order to cut off revenues from resources which could be used to fund Russia’s war effort, banning seaborne crude oil imports in December 2022 and imports of petroleum products in February 2023. Moreover, since December 2022, seven major countries (the G7) and the EU have set a price cap of 60 dollars per barrel on Russian crude oil, banning transactions at prices higher than that.[2] As a result, the Urals price, the benchmark for Russian crude oil, has continued to trend below the international crude oil price. According to Canadian data analysis company Incorrys, the Urals price has been trending at the level of approximately 70% of the North Sea Brent price, the European benchmark, since April 2022.[3] Taking into account this price competitiveness, India moved to purchase Russian crude oil, which it had only imported limited quantities of previously.

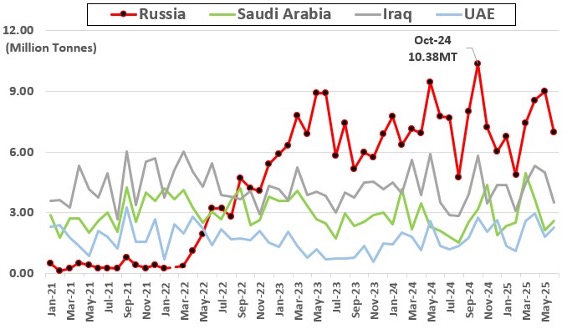

According to statistics from India’s Ministry of Commerce and Industry, India’s imports of crude oil from Russia began to increase from March 2022 and in October 2024 these monthly imports recorded an all-time high at 10.38 million tons (Figure 1). As a result, imports of Russian crude oil became higher than those of Middle Eastern crude oil from Iraq, Saudi Arabia, and the United Arab Emirates (UAE), the countries which were previously India’s major suppliers, and Russia became India’s largest crude oil supplier from 2023 onward.

Figure 1. India’s Monthly Crude Oil Imports (Top Four Countries), January 2021 – June 2025

Imports of Russian crude oil by India also ensure a stable supply of oil for India and reduce its dependence on Middle Eastern crude oil. India has the world’s largest population and has continuously achieved economic growth since the 1990s, so its oil consumption has been expanding year by year. According to the Energy Institute based in the United Kingdom, India’s oil consumption increased by an annual average of 4% over the period from 2014 to 2024, and as of 2024 was third in the world after the United States and China. [4] Meanwhile, India’s domestic crude oil production peaked in 2011 and has been declining since then, so it is necessary for India to secure a lot of crude oil from outside the country in order to support its citizens’ lives and economic activities.

The influx of Russian crude oil is contributing to reducing dependence on Middle Eastern crude oil in India. Russian crude oil’s market share of crude oil imports to India rose from 1% in 2017 to 36% in 2024, while the percentage of imports from the Persian Gulf countries (Iraq, Iran, Oman, Qatar, Kuwait, Saudi Arabia, and the UAE) declined from 63% to 46%. Imports from Middle Eastern oil-producing countries, which are geographically near India, can be completed with fewer transportation days and at less cost than other regions, enabling stable procurement, so they are an ideal supply route for India from the perspective of energy security.

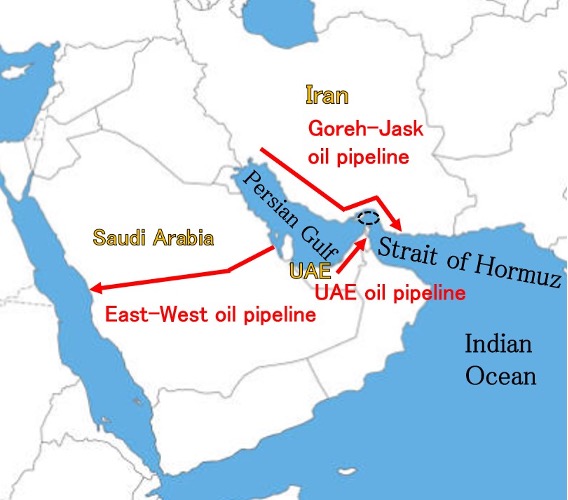

However, since the start of the Gaza War in October 2023, there have been concerns that the destabilization of the situation in the Middle East could disrupt energy supplies from the Middle Eastern oil-producing countries. In particular, the military conflict between Iran and Israel in June 2025 temporarily raised the risk that the Strait of Hormuz would be closed. The Strait of Hormuz is located between Oman and Iran and is a critical shipping lane connecting the Persian Gulf, the Gulf of Oman, and the Arabian Sea. Large volumes of oil and liquefied natural gas (LNG) pass through this strait daily, while alternative routes enabling detours are limited. Firstly, in Saudi Arabia, there is an east-west oil pipeline with a total length of approximately 1,200 km which connects the eastern oil field zone of Abqaiq to the western port city of Yanbu on the Red Sea (and has a carrying capacity of five million barrels per day). Next, in the UAE, there is an oil pipeline with a total length of approximately 360 km which goes from the oil field region of Habshan in the Emirate of Abu Dhabi to the port town of Fujairah located on the Indian Ocean side of the Strait of Hormuz (and has a carrying capacity of 1.5 million barrels per day). Moreover, in Iran, there is an oil pipeline with a total length of approximately 1,100 km which connects Goreh in Bushehr Province to the Jask oil exporting port newly opened in 2021 (and has a carrying capacity of one million barrels per day) (Figure 2). However, given the constraints on the carrying capacities of the pipelines of these three countries (a total of 7.5 million barrels per day), we can conclude that it would be difficult for them to cover the total amount of oil currently passing through the Strait of Hormuz in the case that the strait was closed.

Figure 2. Three Oil Pipelines Bypassing the Strait of Hormuz

In this context, the Iranian Parliament supported closing the Strait of Hormuz in response to the direct attack by the United States on Iran on June 22. [5] Iran began to consider closure of the strait as a way to constrain the United States, which supports Israel, although a decision by Iran’s Supreme National Security Council would be necessary to carry this out. No alternative shipping routes exist in the Strait of Hormuz, so the disruption of the passage of goods resulting from making the strait impassable would have a serious impact on the energy procurement of not only India but also other countries around the world. [6] Given this situation, imports of Russian energy by India can be seen as one of its policies to diversify procurement in order to mitigate its excessive dependence on the Middle East.

India as a “petroleum products exporter”

Securing Russian crude oil also contributes to enhancing the position of India as a petroleum products exporter. India is one of the world’s leading petroleum products exporters, refining crude oil procured from various sources and supplying petroleum products to approximately 160 countries and regions around the world. Its production of petroleum products greatly exceeds domestic demand and it exports the surplus.

According to the Ministry of Statistics and Programme Implementation (MoSPI) of India, of the petroleum products produced in FY2023 (April 2023 to March 2024), 30% of the gasoline, 24% of the diesel, 28% of the naphtha (the main raw material for plastics, etc.), and 50% of the aviation turbine fuel used for jet fuel was exported. [7] India’s refining capacity reached 5.17 million barrels per day as of 2024, the fourth highest capacity in the world after the United States, China, and Russia. [8] India’s exports of petroleum products are also fourth in the world, surpassing those of Saudi Arabia, a major oil-producing country.

India’s refining sector is driven by Reliance Industries, a private conglomerate, and Nayara Energy, which has ties to Russia. Nayara Energy originally traded under the name “Essar Oil” but in 2017 it received investment from Russian state-owned oil company Rosneft and the UCP Investment Group, so the following year, 2018, it changed its name to the current name. Russian crude oil mainly arrives at the Jamnagar Refinery (owned by Reliance Industries) [9] and Vadinar Refinery (Nayara Energy) [10], both in India’s western State of Gujarat.

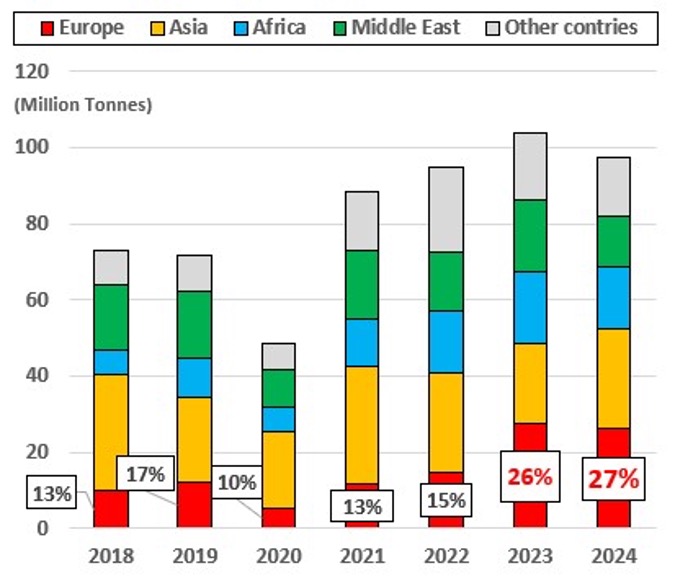

India has been seeking to expand its exports to Europe, where higher profit margins can be expected because Russian petroleum products have been excluded from the market amid the ongoing Ukraine war. India’s exports of petroleum products to Europe have rapidly increased from 11.84 million tons in 2021 to 27.48 million tons (26% of India’s total exports of petroleum products) in 2023, and they remained at the high level of 26.20 million tons (27%) in 2024 as well. Currently, Europe has become an important sales channel for India along with Asia, Africa, and the Middle East (Figure 3). India’s largest export destination is the Netherlands (21.04 million tons), followed by France (1.89 million tons), the United Kingdom (1.76 million tons), Belgium (550,000 tons), and Italy (240,000 tons). The Netherlands in particular is functioning as a distribution hub supporting the energy supply network of all of Europe, [11] and many of the Indian petroleum products delivered to that country are reexported to the other countries of Europe.

In this way, India imports Russian crude oil and exports to Europe the petroleum products made by refining that crude oil, enabling Europe to find a substitute for some of the embargoed Russian oil via India. In other words, Europe, which has imposed sanctions on Russia, is itself reducing the effectiveness of those sanctions through circumventing imports. For India, continuing to procure crude oil from Russia is essential in order to reap the economic benefits from the fluid energy market and continue to maintain its position as a petroleum products exporter amid the ongoing Ukraine war.

Figure 3. Regional Exports of Refined Petroleum Products from India, 2018–2024

India’s oil procurement is disrupted by the Trump administration

The focus going forward will be on whether or not the Trump administration actually imposes secondary tariffs on India. The administration is unhappy about the fact that India is importing large volumes of crude oil from Russia as that country continues its attacks on Ukraine. Given this situation, the Trump administration, through an Executive Order, presented a policy of imposing a total tariff of 50%, comprised of the existing reciprocal tariff of 25% with an additional 25% added on top, thereby putting pressure on India to curb its purchases of Russian energy.

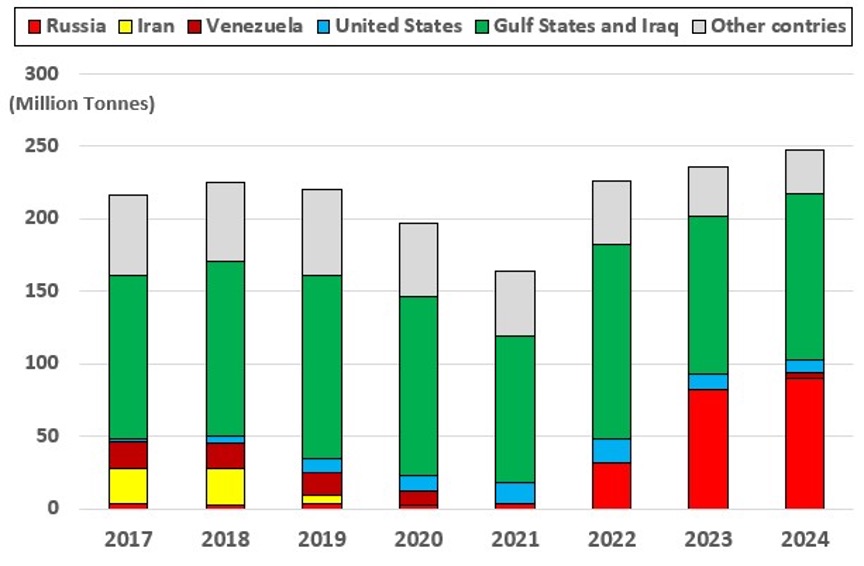

India’s oil procurement has been disrupted by the Trump administration’s foreign policy in the past as well. For example, when the Joint Comprehensive Plan of Action (JCPOA) for the Iran nuclear deal led by the Obama administration took effect in January 2016, India expanded its imports of Iranian crude oil and Iran became the third largest crude oil supplier for India in 2017 and 2018 (Iran’s market share of India’s imports was 11% in both years). However, when the first Trump administration unilaterally withdrew from the JCPOA and launched the “maximum pressure” policy to strengthen sanctions on Iran in May 2018, India took into consideration its relationship with the United States and stopped imports of Iranian crude oil in 2020. Similarly, regarding Venezuela, in 2019 the Trump administration judged that the 2018 Venezuelan presidential election was fraudulent and lacking legitimacy, refused to recognize the second term of office of President Nicolás Maduro, and imposed economic sanctions on the oil sector of Venezuela. As a result, India was forced to reduce its imports from Venezuela, which was India’s fifth largest crude oil supplier (with a market share of 7%) at the time (Figure 4).

Figure 4. Sources of Crude Oil Imports to India, 2016–2024

Given India’s history of complying with restrictions on imports from Iran and Venezuela in consideration of its relationship with the Trump administration, there is a possibility that India will reduce its imports of Russian crude oil due to the pressure from the Trump administration this time as well. In that case, it is conceivable that India will seek additional procurement from Saudi Arabia and the UAE, countries which have spare production capacity, in order to compensate for the decrease in crude oil from Russia. This would enable India to continue supplying petroleum products to Europe, Asia, and others as the “world’s refinery.” However, there is a risk that no longer being able to fully utilize cheap Russian crude oil could increase fuel import costs, resulting in economic burdens such as an increase in domestic inflation and a reduction in petroleum product revenues.

(2025/09/16)

Notes

- 1 “Fact Sheet: President Donald J. Trump Addresses Threats to the United States by the Government of the Russian Federation,” The White House, August 6, 2025.

- 2 Subsequently, in its 18th package of sanctions against Russia adopted on July 18, 2025, the EU lowered the price cap setting for the Urals price from 60 dollars to 47.6 dollars. “EU adopts 18th package of sanctions against Russia,” European Commission, Press Release, July 18, 2025.

- 3 “Brent / Urals Differential 2022-2025,” Incorrys, March 13, 2025.

- 4 “Statistical Review of World Energy 2025,” Energy Institute, June 2025, p.25.

- 5 “Iran’s top security body to decide on Hormuz closure, Press TV reports,” Reuters, June 22, 2025.

- 6 It is important to note that even if Iran does not completely close the Strait of Hormuz physically, a situation could arise in which the strait becomes impassable. Against the backdrop of military clashes and threats and the use of force against ships in the area around the Strait of Hormuz, it can be anticipated that marine insurance companies may suspend the application of marine insurance to merchant vessels passing through the Strait of Hormuz or ask for high war risk insurance premiums. In that case, many ships may be forced to give up on passing through the strait taking into account the navigation risks and economic feasibility. A similar example is that ships affected by the attacks on merchant vessels in the Red Sea by the Houthis based in Yemen have been forced to avoid the shipping route in the Red Sea and detour around to the Cape of Good Hope route.

- 7 “Energy Statistics India 2025,” Ministry of Statistics and Programme Implementation of India, March 2025, p.79.

- 8 “Statistical Review of World Energy 2025,” Energy Institute, June 2025, p.31.

- 9 Alex Travelli, “The Tycoons Who Profit From India’s Thirst for Russian Oil,” The New York Times, August 9, 2025.

- 10 Weilun Soon and Rakesh Sharma, “Sanctions Choke Crude Shipments to Indian Refiner Nayara,” Bloomberg, August 12, 2025.

- 11 Irina Patrahau, Lucia van Geuns and Michel Rademaker, “Energy trade in the Netherlands: Past, present and future,” The Hague Centre for Strategic Studies, January 2023, p.6.

- 12 The figures for petroleum products are calculated based on HS code 2710 in the international trade classification system administered by the World Customs Organization (WCO). Note that the Commonwealth of Independent States (CIS) in the former Soviet bloc is not included in the term “Europe” used in this paper.