Introduction

Shortly after taking office in January 2025, President Donald Trump signed an executive order withdrawing the U.S. from the Paris Agreement, an international framework to combat global warming. Since the U.S. is a major emitter of greenhouse gases, there is concern that the U.S. withdrawal will reverse global climate change measures. By contrast, China, which is another major emitter, has maintained its position on promoting clean energy: energy that does not lead to the emission of carbon dioxide (CO2), which accounts for the majority of greenhouse gases. China now has a presence in the renewable energy and electric vehicle (EV) markets as well as an international supply chain, acquiring the critical minerals used in components and materials from locations around the world.

This paper examines the reasons for China’s move toward clean energy and its aim in securing critical minerals. It also focuses on how strengthening relations with emerging countries will be important for China’s clean energy industry.

China’s Aggressive Adoption of Clean Energy

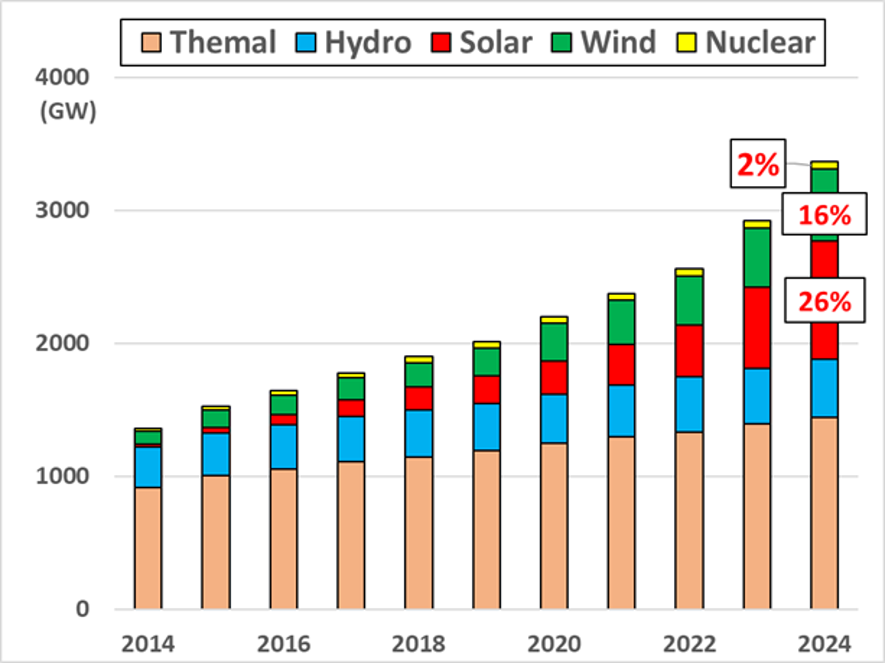

China ratified the Paris Agreement in September 2016 in response to a call from the Obama administration in the U.S., demonstrating to the world its positive approach to combating global warming. Since then, China has taken the lead in introducing renewable energy and nuclear power, the major clean energy sources. From 2014 to 2024, China’s installed capacity for solar power generation increased from 27 gigawatts (GW) to 887 GW. Its installed capacity for wind power also increased significantly from 96 GW to 541 GW. Nuclear power, which does not emit CO2, is also being actively utilized, with the number of nuclear reactors in operation increasing from 24 in 2014 to 57 in 2024,[1] and installed capacity expanding from 20GW to 60GW. As a result, solar, wind, and nuclear power account for 44% of total power generation: a level comparable to thermal power generation, the main power source (Figure 1).

In parallel with the shift to cleaner power generation, there has also been a rapid rise in the popularity of EVs in the transportation sector. Unlike gasoline-powered cars, EVs do not emit CO2 while driving, and are therefore gaining attention as environmentally friendly eco-cars. EV sales in China increased from 0.2 million to 16.1 million battery electric vehicles (BEVs), which run solely on electricity from batteries, during the period from 2015 to 2023. The number of plug-in hybrid electric vehicles (PHEVs), which run on both gasoline and electricity and can be externally charged, also increased from 0.1 million to 5.8 million.[2]

Figure 1: China’s installed power generation capacity by source

Reducing Dependence on Fossil Fuels and Promote Industrial Development

The introduction of clean energy in China has been a state-led initiative to reduce dependence on fossil fuels and promote industrial development, in addition to controlling air pollution. First, while China has the capability to produce crude oil, coal, and natural gas domestically, economic expansion has led to a rapid rise in its consumption of fossil fuels. As a result, the country has had to rely on imports to cover the shortfall. In 2023, China’s crude oil imports were the largest in the world at 560 million tons, equivalent to approximately 70% of its consumption. Natural gas imports also reached 159 billion cubic meters (BCM) via pipeline and liquefied natural gas (LNG), equivalent to approximately 40% of consumption.[4]

This dependence on foreign fossil fuel imports is a major energy security concern for China, due to the risk of supply disruptions. In addition, a substantial rise in resource prices could turn the cost of imports into a major financial burden, negatively impacting the domestic economy. In this regard, China is attempting to slow down the pace of fossil fuel demand by popularizing EVs. At the same time, it is trying to curb the consumption of fossil fuels for power generation by supplementing the power needed to charge EVs with clean energy and diversifying its power supply mix away from reliance on thermal power.

Second, China is focusing on the development of its clean energy industry as a national strategy. With the enactment of China’s Renewable Energy Law in 2005, the Chinese government introduced subsidies and feed-in tariffs (FIT) to expand the development and use of renewable energy. It has fostered the renewable energy and EV industries as strategic emerging industries.[5] These steps reflect China’s need to shift to high-value-added industries in order to sustain economic growth.

Chinese renewable energy companies have been able to compete with Western companies by improving their European-derived technology while reducing costs through mass production within China. However, the entry of Chinese companies has previously led to excessive price competition, especially in the European market. As a result, some Chinese companies had no choice but to withdraw from the sector due to the unprofitable outlook, and the renewable energy business shrank in the early 2010s. The Chinese government endeavored to support the country’s flagging renewable energy industry by maintaining each company’s business scale through the growth of a giant domestic renewable energy market.[6]

Critical Minerals Supporting China’s Green Business

China’s greatest strength as it competes with Western companies in the green business domain is its substantial share of the global production of critical minerals essential to produce clean energy products. China is rich in lithium and graphite, critical minerals essential for lithium-ion batteries (LIBs), a key component of EVs. In 2024, China was the third largest lithium producer (17% of total production) after Australia and Chile, with estimated reserves of 3 million tons (10% of global reserves). China also has the largest share of graphite production and reserves in the world (79% of total production and 28% of total reserves).[7]

On the other hand, cobalt, nickel, and copper, other critical minerals needed for renewable energy and EV products, are only produced in small quantities or are not mined at all in China. To overcome this challenge, China has acquired mineral interests around the world. Chinese companies have invested in and acquired cobalt interests in the Democratic Republic of the Congo (DRC), the world’s largest producer of cobalt, nickel interests in Indonesia, the largest producer of nickel, and copper interests in the DRC, Zambia, and Chile, which are major producers of copper.[8] China controls international supply chains for critical minerals through its direct involvement in mineral projects outside the country and the establishment of a network of sales channels leading to its domestic market.

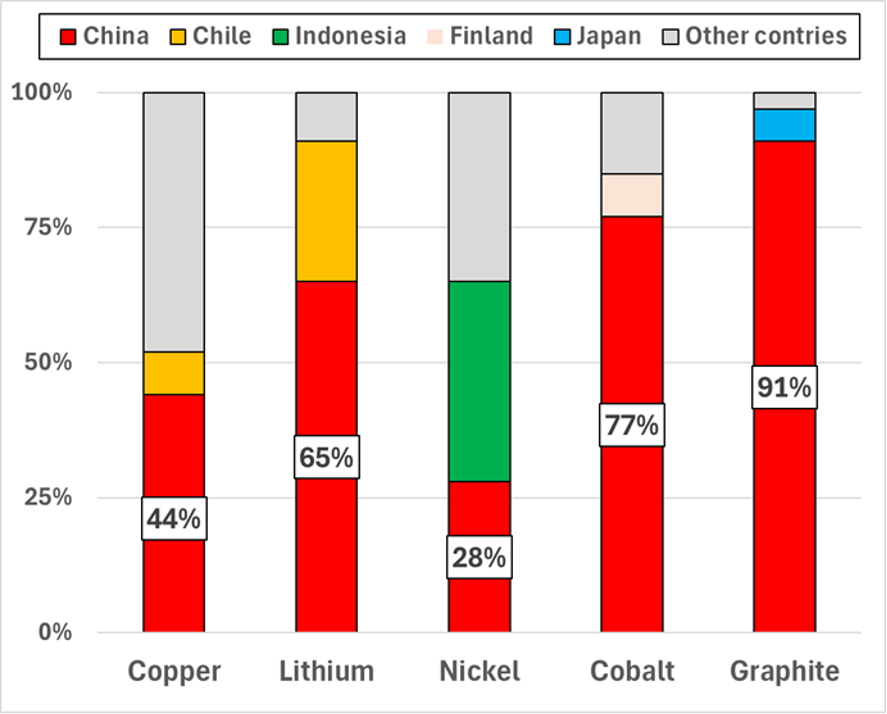

Moreover, by combining its efforts to secure critical minerals with refining and processing technologies, China is further strengthening its home-based global supply chain. As of 2023, China boasted a 91% share of global mineral refining and processing volume for graphite, 77% for cobalt, 65% for lithium, 44% for copper, and 28% for nickel (Figure 2).

Figure 2: China’s share of global mineral refining and processing volume (2023)

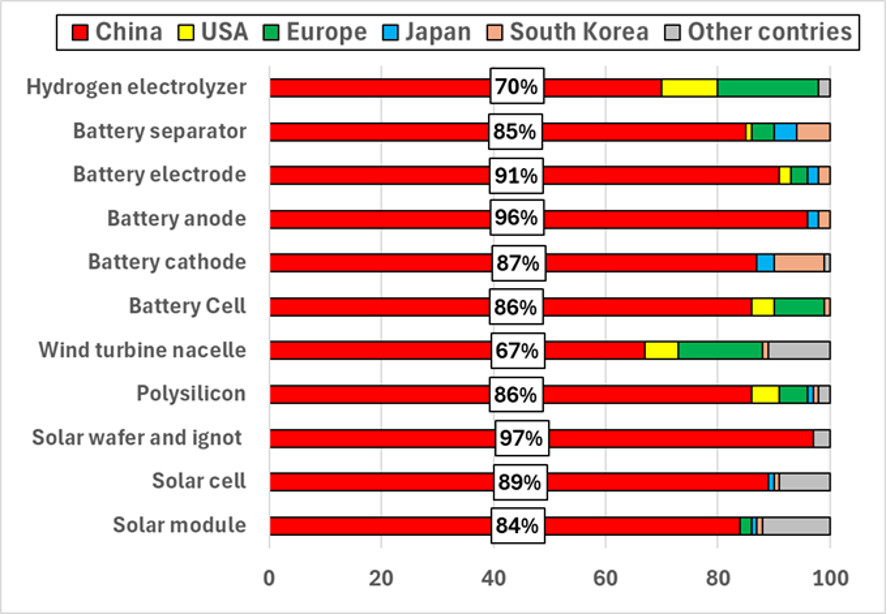

Furthermore, China’s success in creating components and materials from critical minerals and industrializing the end products has dramatically improved its international competitiveness in the clean energy sector. China has a market share of over 70% of global production capacity for solar and wind power generation, LIBs for EVs, and hydrogen-related components (Figure 3). With their advantage in pricing, Chinese companies are dominating their Western counterparts in the global competition for orders.

Figure 3: Global share of production capacity for renewable energy, EV components, and hydrogen-related components (2023)

Potential Expansion of the Renewable Energy Business in Emerging Countries

On the other hand, Chinese subsidies have reduced the price of China-made EVs and solar components, raising concern among Western countries over this distortion of market practices to spread Chinese products. Moreover, given China’s control over international supply chains for many critical minerals, it is feared that excessive reliance on China for procurement may lead to vulnerability to supply disruptions. In a case in point, in December 2024, China implemented a general ban on exports to the U.S. of rare metals such as gallium, germanium, and antimony, which are necessary for the manufacture of electronic components, as a countermeasure against tighter U.S. controls on the export of semiconductors to China.

Given the efforts by Western countries to reduce their dependence on China in the areas of clean energy and critical minerals, Chinese companies may face significant restrictions on exports to the West and their business participation in Western countries in the future. There is also a fear that the bloated domestic market may gradually become saturated due to government support measures. So far, Chinese companies have attempted to lower production costs through a management approach dependent on large-scale capital investment. This approach is only viable if there is the prospect of access to large markets. Therefore, it is essential for China to expand its sales channels in emerging countries, with which it has strengthened its solidarity through regional frameworks such as the BRICS[11] and the Shanghai Cooperation Organization.[12]

The trend toward decarbonization since the adoption of the Paris Agreement and the ample funds available from Middle Eastern oil-producing countries provided tailwinds for China's clean energy policy. In emerging countries too, the introduction of renewable energy and EVs is expected to increase further in response to the global trend toward decarbonization. In addition, the “Outcome of the first global stocktake” of the 28th Conference of the Parties (COP28) to the United Nations Framework Convention on Climate Change (UNFCCC), held in the United Arab Emirates (UAE) in 2023, states that the global installed capacity for renewable energy generation should triple by 2030.[13]The UAE, which hosted COP28, has been actively investing in new domestic gigawatt-class solar power plants, as well as solar and wind power generation projects overseas, mainly in Africa and Central Asia, to add effect to the COP28 outcomes. Like the UAE, Saudi Arabia is also developing renewable energy projects at home and abroad.[14]

As the Middle East oil-producing countries of the UAE and Saudi Arabia bolster the scale of the renewable energy market, Chinese companies have been awarded engineering, procurement, and construction (EPC) contracts and selected as suppliers of solar components for projects in both countries. China is an important destination for oil exports from the UAE and Saudi Arabia, and good relations have been maintained over many years through these oil transactions. In this sense, it is likely that these countries are less wary than Western countries of Chinese companies and have high expectations for China’s role in the clean energy sector. Going forward, it will be vital for China to collaborate with emerging countries in the Global South, distinct from Western countries, to maintain and expand its own clean energy industry.

China’s Role in a Decarbonizing World

As discussed so far, China has been actively introducing clean energy to curb fossil fuel consumption from the perspective of energy security. It has further developed its clean energy industry through the expansion of domestic renewable energy and EV businesses. By gaining control over critical minerals in various parts of the world, China has seized an overwhelming share of the global market for renewable energy and EV component production, making it difficult to develop green business without China. Even if Western countries tighten their restrictions on China, China is expected to maintain its influence in the clean energy sector by focusing on gaining a business foothold in the Middle East oil-producing countries and other emerging countries.

In a world moving toward decarbonization, China’s role in driving the clean energy industry cannot be ignored. Although the birth of the Trump administration has led the U.S. to announce its withdrawal from the Paris Agreement, European countries that have coordinated the Paris Agreement are continuing their decarbonization policies to achieve carbon neutrality by 2050. Japan also indicated in its Seventh Strategic Energy Plan,[15]approved by the Cabinet on February 18, that it intends to raise the proportion of total power generated using renewable energy to around 40–50% by FY2040.

Amid the pressure to decarbonize, the recent development of the artificial intelligence (AI) industry and the expansion of data centers are expected to increase the demand for electricity worldwide. The option of cooperating with China in the clean energy sector should be fully considered as one way to address the pressing challenges of decarbonization and maintaining a stable power supply.

(2025/03/17)

Notes

- 1 “我国核电运行年度综合分析核心报告(2023年度)," China Nuclear Energy Industry Association (CNEA), April 29, 2024; “全国核电运行情况(2024年1-12月),” National Nuclear Safety Administration (NNSA), February 6, 2025.

- 2 “2024 Statistical Review of World Energy,” International Energy Agency, April 2024.

- 3 For data on generation installed capacity, see “2014~2016年全社会用电量等数据,” National Energy Administration for 2014 to 2016 and “2017~2024年全国电力工业统计数据,” National Energy Administration for 2017 to 2024.

- 4 “Global EV Outlook 2024,” Energy Institute, June 2024.

- 5 Zhidong Li, “The Renewable Energy Industry Leading the World: How to Promote Japan-China Cooperation” in Kazuro Yukawa, Kenji Yuasa, and Japan Center for Economic Research (JCER) (eds.), New Chinese Industrial Theory: Its Policies and Corporate Competitiveness, Bunshindo, 2024, pp. 115–120.

- 6 Hitoshi Ikuma, Ting Wang, and Shinichiro Takiguchi, China’s Domination of the World Energy Market: Risks and Opportunities, Nikkan Kogyo Shimbun, 2019, pp. 25-36.

- 7 U.S. Geological Survey, 2025, Mineral commodity summaries 2025: U.S. Geological Survey, pp. 85-111.

- 8 “Digging deeper: Understanding the global Chinese mining sector,” Transparency International Australia, November 2024, p.8.

- 9 “Global Critical Minerals Outlook 2024,” International Energy Agency, May 2024.

- 10 Jennifer A Dlouhy, “China Extends Clean-Tech Dominance Over US Despite Biden’s IRA,” Bloomberg, April 16, 2024.

- 11 In addition to China, India, Brazil, South Africa, and Russia, the five major BRICS countries, Iran, Egypt, Ethiopia, and the UAE became new members in January 2024, followed by Indonesia in January 2025.

- 12 The Shanghai Cooperation Organization was established in 2001 by China, Uzbekistan, Kazakhstan, Kyrgyz Republic, Tajikistan and Russia. Iran, India, Pakistan, and Belarus subsequently joined the organization.

- 13 “Outcome of the first global stocktake. Draft decision -/CMA.5. Proposal by the President,” United Nations Framework Convention on Climate Change, December 13, 2023, p.5.

- 14 For more information on renewable energy projects in the UAE and Saudi Arabia, see Kohei Toyoda, “Overall Energy Transition in Saudi Arabia and the UAE: The ‘Opportunity’ of Climate Change,” Oil and Natural Gas Review, November 2024, Japan Organization for Metals and Energy Security (JOGMEC), pp. 33–67.

- 15 “Seventh Strategic Energy Plan (February 2025),” Agency for Natural Resources and Energy, Ministry of Economy, Trade and Industry, February 18, 2025.