Introduction

Since the Russian invasion of Ukraine in February 2022, the European Union (EU) has pursued policies aimed at shifting its energy sources away from Russia. This has resulted in a decline in the bloc’s dependence on Russian energy. Meanwhile, Russia has focused on exporting oil and natural gas to regions outside the EU to maintain its resource revenue. This paper analyzes the achievements and challenges facing this EU policy of ‘de-Russification’ and the trends among countries actively purchasing fossil fuels from Russia. It also examines the outlook for sanctions against Russia.

The Achievements and Challenges of ‘De-Russification’

Faced with the crisis in Ukraine, the EU has strengthened sanctions against Russia, attempting to break free of its dependence on Russian fossil fuels to stem the flow of resource revenue into the Russian war machine. After halting crude oil imports by sea in December 2022, the EU went on to prohibit the import of petroleum products in February 2023. While attempting to reduce its natural gas consumption by 15% to control the amount of Russian gas imported, the EU also plans an import embargo on all Russia-sourced energy by 2027. The G7 countries and the EU have also set an export price cap of USD 60/barrel on Russian crude oil as an additional sanction.

The EU’s de-Russification policy has successfully reduced the entire bloc’s dependence on Russian energy. Russia’s share in extra-EU imports of petroleum oil fell dramatically from 27% before the invasion of Ukraine (in the fourth quarter of 2021) to 3% after the embargo came into effect (in the fourth quarter of 2023). Natural gas imports also decreased from 33% to 13%[1].

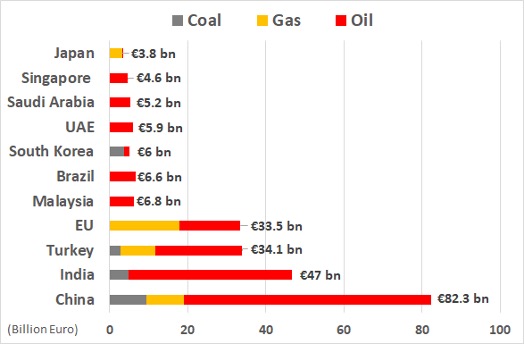

Meanwhile, the EU’s imposition of sanctions targeting Russia provided an opportunity for Russian fossil fuels to flow into other regions. The Centre for Research on Energy and Clean Air (CREA), a think-tank based in Finland, compiles estimates of the monetary value of Russian fossil fuels procured by each country and region (Figure 1). Since the EU imposed its embargo on crude oil shipments, the country that purchased the most from Russia was China, at EUR 82.3 billion, followed by India and Türkiye, at EUR 47.0 billion and EUR 34.1 billion, respectively. The EU came in fourth, with oil and gas imports continuing mainly through pipelines to Eastern Europe. Notably, the oil-producing countries of Saudi Arabia and the United Arab Emirates (UAE) are purchasing oil (crude oil and petroleum products) from Russia.

Figure 1: Value of Russian fossil fuels purchase(January 1, 2023 to January 24, 2024)

Despite the EU’s restrictions on Russian-sourced energy, Russia has been able to maintain a substantial level of resource revenue by progressively selling to other countries. This has blunted the effectiveness of the sanctions imposed by the West.

China and India: Growing Markets for Russian Crude Oil

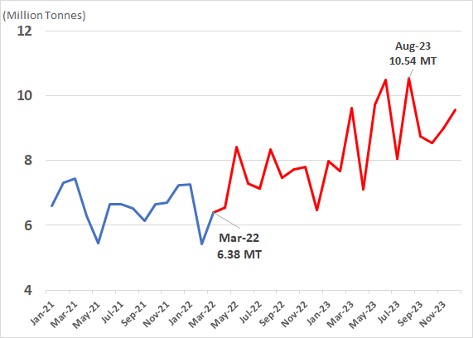

Why, then, are China and India purchasing Russian fossil fuels, and crude oil in particular? Since the advent of the Ukraine crisis, both countries have been progressively increasing the amount of crude oil they import from Russia. According to statistics compiled by China’s General Administration of Customs, monthly imports have increased from 6.38 million tons in March 2022 to 10.54 million tons in August 2023. Annual imports in 2023 exceeded 100 million tons for the first time. By country, Russia also surpassed Saudi Arabia as China’s largest supplier.

Figure 2: China’s monthly crude oil imports from Russia (2021 to 2023)

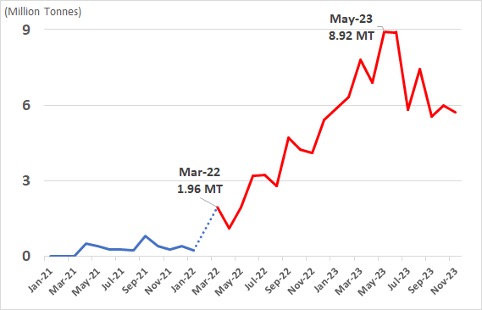

Likewise, India, which historically imported little crude oil from Russia, partly due to the geographical distance, has rapidly stepped up its imports since the invasion of Ukraine. According to statistics compiled by India’s Ministry of Commerce and Industry, its imports of Russian crude oil increased from March 2022 onward, with the total amount imported during 2022 exceeding 33 million tons. Crude oil imports from Russia continued to grow into 2023, with monthly imports in May 2023 reaching a record-high level of 8.92 million tons. Annual crude oil imports from Russia in 2023 are expected to be at least 80 million tons.

Figure 3: India’s monthly crude oil imports from Russia (January 2021 to November 2023)

The primary reason why India and China are actively purchasing Russian crude oil is that, with their massive populations, these two countries are second only to the U.S. in terms of petroleum consumption. China was the second largest consumer of crude oil in the world (in 2021), accounting for 16% of all oil consumed, while India, in third place, accounted for 5%[2]. As a result, both China and India must secure massive quantities of crude oil to support their citizens’ standard of living and economic activity. By procuring crude oil from Russia, both countries are endeavoring to expand their oil reserves while also meeting the domestic demand.

The second reason, in the case of India, is that it aims to utilize Russia-sourced crude oil to enter the market for petroleum products in Europe, from which Russia itself is excluded[3]. Economic sanctions have pushed the price of crude oil from Russia below international oil prices. Indian companies are procuring huge amounts of this discounted crude oil and using it to produce refined petroleum products targeting the highly profitable European market. The stable procurement of crude oil from Russia is therefore crucial for India, enabling the country to continue to reap economic benefits from volatile energy markets in the context of the Ukraine crisis.

Middle Eastern Oil-Producing Countries Shop for Russian Crude Oil

In a further development, Saudi Arabia and the UAE, themselves oil-producing countries, are also purchasing crude oil from Russia. In 2016, these two leading members of the Organization of Petroleum Exporting Countries (OPEC) launched OPEC+ as a framework for coordinating production with non-OPEC oil-producing countries, including Russia. This coordination was designed to boost their petroleum revenue. Since the start of the Ukraine crisis, Saudi Arabia and the UAE have imported Russian crude oil and petroleum products, trading at a discount to international oil prices due to the impact of economic sanctions, to supply their domestic petroleum consumption. This has enabled them to sell their own crude oil at higher prices on overseas markets[4].

Imports of Russian crude oil by Saudi Arabia reached 2.86 million tons in the first half of 2023, eclipsing the 1.63 million tons imported during the whole of 2022[5]. Likewise, the UAE purchased approximately 39 million tons of crude oil from Russia from January to April 2023. Most of the UAE’s imports of Russian crude oil are thought to be re-exported from the Port of Fujairah in the east of the nation to Asia, Africa, and South America[6]. By procuring energy from Russia, Saudi Arabia and the UAE are boosting their own resource revenues, while also supporting the Russian economy.

Outlook: Will Russia Be Able to Maintain its Resource Revenue?

Given this flow of Russian energy to countries outside the EU, it is unlikely that sanctions will eliminate Russia’s resource revenue, although they may reduce it. China and India will persist in purchasing crude oil from Russia to meet domestic demand and refine it into petroleum products for sale, while Saudi Arabia and the UAE have no hesitation in buying Russian oil for resale, profiting from the pricing gap. The forecast expansion of natural gas imports from Russia by countries such as China and Turkey also indicates that Russia will probably be able to maintain its resource revenue.

The countries that actively purchase Russian fossil fuels have maintained their ties with Russia despite the sanctions imposed by Europe and the U.S. Russia, China, and India are linked through regional cooperative frameworks that do not include Europe or the U.S., such as BRICS and the Shanghai Cooperation Organization (SCO). Meanwhile, Russia has worked with Saudi Arabia and the UAE to promote energy cooperation through the OPEC+ framework, aimed at countering the U.S. shale oil industry in international oil markets. Each of these countries aims to maintain its relationship with Russia through energy imports, pursuing its own economic benefits from Russian energy. For this reason, these countries are likely to firmly resisted any display of sympathy with the embargo on Russian fossil fuels led by Europe and the U.S.

Western countries have strengthened their monitoring of the flow of fossil fuels from Russia in response to this rampant ‘oil laundering.’ On January 18, 2024, the U.S. Office of Foreign Assets Control (OFAC) announced sanctions against a shipping company based in the UAE, claiming that the company had violated the price cap of USD 60/barrel on Russian crude oil exports[7].

Meanwhile, on January 21, Ukraine attacked the export port of Ust-Luga on the Gulf of Finland, west of St. Petersburg, bringing operations to a standstill[8]. Ukraine went on to attack the southern Tuapse oil refinery on Russia’s southern Black Sea coast on January 25, demonstrating its capacity to directly damage Russia’s energy-related facilities[9].

Going forward, if Russia’s export activities are hamstrung by further attacks on its resource-exporting facilities, then the resource revenue Russia derives from these exports will dwindle considerably. It is feared, however, that cross-border assaults on Russia’s oil and gas facilities will provoke further retaliation against Ukraine, leading directly to an escalation of the Ukraine situation. There is also the risk that the disappearance of Russian-sourced energy from international markets would result in a sharp rise in international resource prices, dealing a blow to Western economies.

(2024/03/11)

Notes

- 1 “EU trade with Russia - latest developments,” Eurostat, November 2023.

- 2 “What countries are the top producers and consumers of oil?” Energy Information Administration, September 22, 2023.

- 3 “Europe bought Russian oil via India at record rates in 2023 despite Ukraine war,” The Times of India, January 12, 2024.

- 4 “Russian Oil Hidden Big Buyers: Saudi Arabia and UAE to Buy Russian Oil at Low Prices and then Sell at High Prices to Europe,” Hellenic Shipping News, April 20, 2023.

- 5 Jeslyn Lerh, “Saudi Arabia imports record Russian fuel oil in June as trade grows,” Reuters, July 13, 2023.

- 6 Eleonora Ardemagni, “Oil, Gold and “Dual-use”: Why the Russian Elite Relocates in Dubai,” Italian Institute for International Political Studies, November 6, 2023.

- 7 “Russia-related Designations and Designation Update; Counter Terrorism Designation Update; Issuance of Russia-related General Licenses and Amended Frequently Asked Question,” Office of Foreign Assets Control, January 18, 2024.

- 8 Sarah Rainsford, “Ukraine drones hit St Petersburg gas terminal in Russia,” BBC, January 21, 2024.

- 9 Robert Perkins and Kelly Norways, “Rosneft's Tuapse refinery damaged after suspected Ukrainian drone strike,” S&P Global Commodity Insights, January 25, 2024.