Publication of working papers for the SPF project “Shaping the Pragmatic and Effective Strategy Toward China”

IINA (International Information Network Analysis) will upload the working papers written by U.S. and Japanese project members focusing on shaping a pragmatic and effective strategy toward China. We hope that this series will help IINA readers understand how experts from the U.S. and Japan see China and the U.S.-Japan joint efforts, which have the potential to determine the future world order.

Introduction[1]

The burgeoning digital economy presents an array of opportunities and challenges for the United States and Japan. Crafting international rules that sustain free and safe data flows, protecting infrastructure for advanced mobile communications, and solving supply chain shortages in the semiconductor industry are top priorities for policymakers in both countries. In pooling efforts to achieve these objectives, the United States and Japan have a chance to craft a digital alliance that modernizes their partnership as they adjust to the forces of technological shift, the pandemic shock, and geopolitical competition. The value proposition, however, rests on the ability of the United States and Japan to leverage bilateral cooperation to achieve a wider impact in disseminating far-reaching rules and standards and shoring up global value chains. Success in this endeavor will in no small measure shape how effectively the U.S. and Japan cope with the China challenge given China’s high-tech ambitions, its digital protectionism, and its growing influence abroad through initiatives such as the Digital Silk Road.

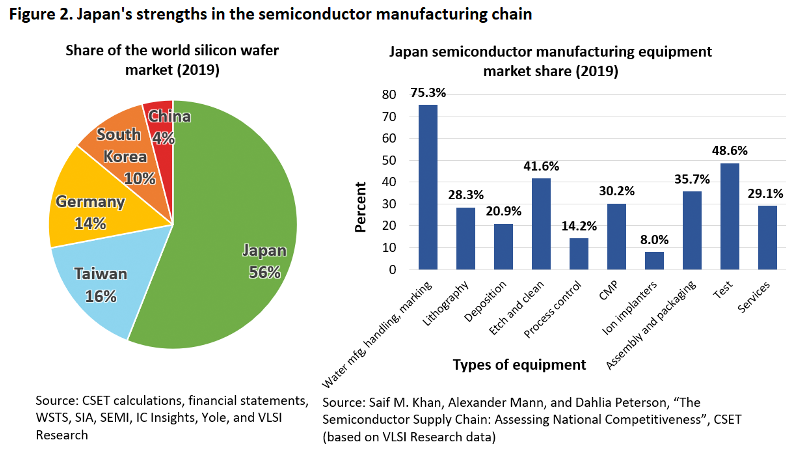

In pooling efforts to advance a shared digital agenda, the United States and Japan can bring to bear significant strengths. The United States ranks at the top of the world’s digital competitiveness index[2], is home to corporate giants in the information technology industry, and American semiconductor firms top global sales and lead in important production segments such as chip design and manufacturing equipment. While Japan’s dominant position in the semiconductor industry is a thing of the past, Japanese companies still enjoy dominant positions in key nodes of the semiconductor supply chain such as silicon wafers, advanced chemicals and manufacturing equipment. These chokepoint technologies are of increased relevance at a time of heightened tech competition and vulnerability. Moreover, Japan is at the forefront of codifying and disseminating rules and standards for the digital economy with a template that aligns with American priorities (i.e. the original and revised Trans-Pacific Partnership and the U.S.-Japan digital trade agreement), has set forth the Data Free Flow with Trust (DFFT) initiative, and is a co-convener of World Trade Organization (WTO) e-commerce talks.

But allied coordination on digital policy and governance confronts significant challenges as each partner balances the benefits and risks of economic interdependence with China, opts for different implementation strategies, and incorporates its own domestic priorities. The analysis below explores tasks ahead in building a U.S.-Japan digital alliance around three pillars: advanced tech manufacturing (semiconductors), telecommunication platforms (5G and beyond), and international digital governance. These are not the only vital policy dimensions to the digital agenda (in fact, the docket is full and will continue to grow in areas such as AI, cybersecurity, etc.), but they do figure prominently in the “Competitiveness and Resilience (CoRe) Partnership” launched at the U.S.-Japan leaders’ summit in April 2021[3]. What then is at stake in developing a digital pillar to U.S.-Japan alliance? How can the allies devise a coordinated digital agenda to effectively address the China challenge? And what are potential pitfalls ahead?

1.Powering the digital transformation: the semiconductor industrial base and supply chain resilience

Shifting fortunes in semiconductor prowess

Semiconductors have held pride of place in U.S.-Japan relations for decades. In the 1980s, many fixated on this sector as emblematic of the shifting fortunes of each nation: decline for the United States when its worldwide market share of semiconductors dropped to 39 percent by 1988; and rise for Japan in taking more than half of semiconductor sales in the world[4]. Semiconductors were at the heart of one of the most bitter episodes of bilateral trade friction. The 1986 semiconductor agreement broke new ground in two main areas, namely, commitments from Japan to eliminate dumping in the United States as well as in third markets, and language on a 20 percent share for American firms in the Japanese market five years hence. However, the semiconductor agreement did not fix the trade dispute. The third country dumping commitments were later found to be GATT-illegal, the U.S. imposed a 100 percent tariff on 300 million dollars of Japanese imports citing insufficient progress on the dumping charges, and the American and Japanese governments vehemently disagreed on whether 20 percent market share represented a binding commitment or a desirable goalpost (Irwin, 1996).

The semiconductor agreement unleashed larger forces that transformed the industry. Rising prices for semiconductors paved the way for new entrants into the industry that chipped away at Japan’s lead. At the same time, the Japanese government redirected its research sponsorship away from silicon projects. Perhaps even more consequential was the fact that Japanese producers failed to adjust to the technological shifts in the industry and remained wedded to their advantage in memory chips, failing to see that logic chips would capture much larger market shares (Okada, 2006, p. 71, 80). The prognosis of American defeat and Japanese victory in the semiconductor race proved utterly wrong. By the 1990s, American firms had regrouped and captured close to half of the world’s semiconductors sales, and Japan’s share shrank to a mere 10 percent.

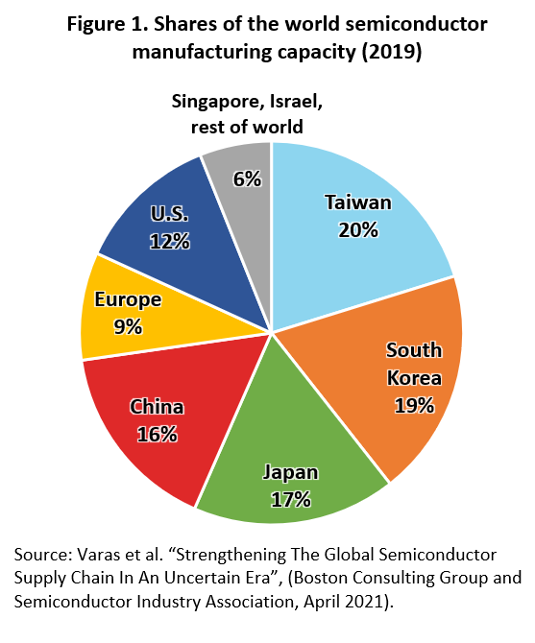

Ever since, the transformation of the industry has continued unabated. Several drivers and features are worth highlighting. 1) Sustained technological innovation with short product lifecycles. The miniaturization trend is illustrative with frontier fabs now capable of producing 5 nanometer (nm) chips. 2) Mammoth capital expenditures to sustain R&D activities and top of the line foundry/manufacturing facilities. For example, the cost of an advanced semiconductor fab can reach 12 billion dollars. Consequently, there are heavy entry barriers to the sector and high industry concentration with a handful of companies dominating specific segments of the chip sector. 3) The fragmentation of production and sprawling global supply chains. While some fully integrated manufacturers remain (e.g. Intel and Samsung), the industry has been redefined by the rise of fabless chip design firms (headquartered mostly in the U.S.) and contract foundry (located predominantly in Taiwan). Semiconductor manufacturing has globalized with fragmentation of production and the procurement of hundreds of materials across national borders. In some cases, inputs cross borders seventy times (White House Report, 2021: 27, 35). 4) Geographical concentration of semiconductor manufacturing on what could best be described as the “rise of the rest in northeast Asia.” Figure 1 shows that 72 percent of the world’s semiconductor manufacturing capacity is located in this corner of the world, while the U.S. and Europe account for 12 percent and 9 percent respectively.

But northeast Asia’s semiconductor capabilities are not alike. Taiwan and South Korea are at the cutting edge of advanced chip manufacturing aiming to cross the 3 nm threshold soon. Yet, while Taiwanese firms like TSMC operate as pure-play foundries, the South Korean giants Samsung and SK Hynix absorb the vast majority of the chips they manufacture due to their vertical integration. Japan still leads the world by number of semiconductor factories, but these facilities produce older chips in the range of 40-130 nm (METI, 2021a). And yet, Japanese firms play a dominant role in key nodes of the semiconductor manufacturing chain. As shown in Figure 2, Japanese companies hold 56 percent of the silicon wafer market and their lead in semiconductor manufacturing equipment is especially pronounced in wafer, etch and clean, testing, assembly and packaging equipment. Extreme ultraviolet lithography equipment (EUV) is a critical chokepoint since it is indispensable to produce transistors beyond 7nm and China has not yet mastered this technology. While the Dutch firm ASML is the only firm capable of manufacturing at scale EUV exposure equipment, other Japanese firms (Tokyo Electron and Lasertec) provide the needed peripheral equipment in EUV equipment. exploiting a key vulnerability: its reliance on American design, equipment, and chips[5]. Japanese firms excel in advanced materials, capturing 53 percent of the photomask market (White House, p. 47, 51), and in chemicals such as fluorinated polyimides (90 percent market share), etching gasses (70 percent) and photoresists (90 percent)[6].

The China challenge in chip manufacturing

It is the growing high-tech ambitions of China which has garnered most attention and concern. With 16 percent of the world’s integrated circuit (IC) manufacturing capacity in 2019, the Chinese government has made an all-out push to dominate this sector by 2030, citing economic and national security reasons. The stated goal is to achieve near self-sufficiency with domestically manufactured chips meeting 80 percent of China’s needs. This would represent a major leap given that in 2019 domestic IC manufacture accounted for slightly less than 16 percent of domestic consumption (Duchatel, 2019: 7). Government support has been multidimensional and generous: tax breaks, trade and investment protections, support for overseas acquisitions of high-tech firms, programs to recruit talent from abroad, and subsidization of R&D and production facilities. According to the Semiconductor Industry Associations, the Chinese state has earmarked 145 billion dollars in semiconductor subsidies for the 2015-2025 period (cited in White House report, 2021: 61). It is not just the magnitude of state support, but also the form, below-market equity investments, which is unique to China. In 2014, China launched the first National Integrated Circuit Investment Fund (23 billion dollars)[7], and in 2019 a second tranche for 28.9 billion dollars was authorized (Platzer et al., 2020: 28). Looking at the prevalence of such state support practices in China, an OECD (2019: 52) report concludes: “The overall picture that emerges is one of opaque ownership linkages in China’s semiconductor industry, where it can be difficult to identify the ultimate beneficial owners of companies and to ascertain the precise extent of state influence or ownership.”

China has made headway in the production of mid-range semiconductors (25-48 nm chips), but the manufacturing of the most advanced chips is still out of reach. Only one Chinese firm can produce 14 nm chips, and several would-be national champions have fallen by the wayside, despite generous government support. As Mathieu Duchatel (2021) points out, China’s indigenization ambitions are likely to be frustrated not only by the need to import advanced chips, but also by its continued reliance on foreign software design and equipment. However, a deteriorating international environment has only redoubled China’s zeal in achieving technological independence.

An inflection point: the geopolitics of semiconductor manufacturing

Semiconductors have long been considered a strategic sector. However, a trifecta of developments has elevated the importance of the microelectronics industry to commanding heights in the global economy. First, the technological revolution (AI, 5G telecommunications, edge computing, the Internet of Things, etc.) has drastically amplified the demand for ever more sophisticated semiconductors. The dual-use nature of these emerging technologies means that semiconductor manufacturing prowess is desirable both for economic competitiveness and national security purposes. Second, the COVID-19 shock further exacerbated chip demand and sensitivity to risks of production disruptions. The pandemic further pushed the digitalization trend that rests on microelectronic devices while lockdowns and sharp swings in supply and demand patterns exerted enormous pressures on supply chains. The chip crunch in the automobile industry has been severe. A case in point is Toyota’s 40 percent production cut in September 2021 due to chip shortages[8].

Third, tech rivalry is at the center of U.S.-China competition and semiconductors are ground zero. Concerned over China’s civil-military fusion, high-tech ambitions, and reliance on predatory practices (IP theft, forced technology transfers), the United States has moved to curb Chinese access to its advanced technologies and to dent the Chinese semiconductor drive by exploiting a key vulnerability: its reliance on American design, equipment, and chips. Tighter national security oversight of inward investment has brought Chinese acquisition of high-tech American firms effectively to a halt, American 301 tariffs imposed a 25 percent tax on imports of Chinese semiconductors, and the Entity List (requiring a license for sales with the presumption of denial) has been used to cut off Chinese firms’ access to advanced chips not just from American firms, but from foreign firms as well (Bown, 2020). For example, in spring 2020 TSMC stopped taking new orders from Huawei to comply with American sanctions[9].

Applying this leverage has its costs, however. American semiconductor firms have complained that losing the Chinese market would prevent them from sustaining their heavy R&D investments and third-party firms have reported negative effects from both the trade war and tech restrictions (Sun et al., 2019). As China readies retaliatory tools through tightened export controls and lists of unreliable suppliers, firms in the semiconductor supply chain must grapple with geopolitical risk and the growing bifurcation of semiconductor/high-tech ecosystems (Solís, 2021).

The comeback of industrial policy

One important vector in the securitization of chip manufacturing is the growing appetite among policymakers for industrial policies that seek to buttress the domestic manufacturing base and mitigate the risks inherent to international production networks. Location and trust have emerged as key variables in the policy debates about the future of this vital industry. There is of course past precedent of the U.S. government stepping up to assist American semiconductor firms when their competitiveness appeared to be dwindling (the private-public research consortium Sematech was created in 1987 but public funding was phased out by 1996) and offering continuous budgetary support for pre-competitive R&D.

Today, industrial policy once again beckons the American body politic. U.S. President Joe Biden’s White House taskforce on the semiconductor supply chain identified as major risks the lack of U.S. domestic manufacturing at the technological frontier (5nm and below), the geographical concentration of foundries in East Asia, China’s attempts to build an indigenous semiconductor industry with a state-led model, and the dependence of American semiconductor companies on the Chinese market. To boost American competitiveness, there are recommendations for investments in R&D, infrastructure modernization, and the nurturing of human capital. There is also a push to attract investment into the United States to all domains of the semiconductor ecosystem and to coordinate with allies to increase supply chain resilience. Federal funding bills for the semiconductor industry in the ballpark of 52 billion dollars to support R&D and boost domestic manufacturing capabilities enjoy broad bipartisan support (but funding authorization is still pending)[10]. Lured by the prospects of attractive incentive packages, TSMC and Samsung have announced future investment plans in Arizona and Texas, respectively[11]. Competing with China has given sails to American industrial policy — the effort though seems less geared toward nurturing national champions than bringing cutting-edge manufacturers to the homeland.

Japanese policymakers have also grown wary of China’s challenge to the liberal international order. They have sought to mitigate the risks of economic overdependence on China and have strengthened measures to protect critical technology and infrastructure. New economic security teams have been added to the National Security Council, the Ministry of Economy, Trade and Industry (METI), and the Minister of Foreign Affairs (MOFA). The 2020 Basic Policy for Economic and Financial Management embraced economic security by stating that Japan must aim for both strategic autonomy and strategic indispensability (Cabinet Office, 2020). In other words, achieving self-reliance in areas critical to national security and securing Japan’s international influence through technological prowess are state priorities. In a much-noted move, the Japanese government initiated a subsidy program for Japanese companies operating in China to re-shore or diversify into Southeast Asia their operations. At 3.1 billion dollars, the program to strengthen supply chains is not intended to bring about decoupling. Its aim is to facilitate risk-hedging not only vis-à-vis pandemic disruptions, but also rising geopolitical tensions impacting high-tech manufacturing (Solis, 2021).

Industrial policy appears to be making a comeback in Japan. In a new strategy document, METI elevated the strengthening of the semiconductor industry to a “national project,” on par with past efforts to ensure energy security and stable food supplies. Japanese industrial bureaucrats have painted a sobering picture of chip manufacturing driven by two main factors. First, the prevalence of legacy factories and the inability of Japanese firms to make the technological leap into miniaturized logic chips and the fabless model have resulted in a shrinking market share. Competitive pressures are only intensifying as governments in Europe, Asia, and North America are scaling up subsidies to boost domestic manufacturing capabilities. Second, as other countries aim to build semiconductor industrial hubs, there is concern that Japanese firms that enjoy competitiveness in chokepoint segments (materials and equipment) may relocate abroad, hollowing out Japan’s chip industry (METI, 2021a).

To prevent the eclipse of Japanese semiconductors, METI proposes two lines of effort: government support for R&D and domestic manufacturing, and international alliances. In the ministry’s estimation, 5 trillion yen (45.6 billion dollars) will be required just to sustain Japan’s current share of the global market at 10 percent until 2030. To produce advanced chips in Japan, METI seeks joint research and production ventures with frontier foundries headquartered in Taiwan and the United States. TSMC’s decision to open an R&D center in Tsukuba with a consortium of Japanese companies and a public R&D institute, and to join hands with Sony to build a fab in Kumamoto are important steps in this direction (Duchatel, 2021). The brand-new Kishida government is said to be considering subsidies to cover half of the projected investment costs of $8.8 billion dollars through the New Energy and Industrial Technology Development Organization[12].

Advanced manufacturing is increasingly a focal point for U.S.-Japan coordination. Both countries share concern over the gaps in their domestic manufacturing bases on cutting edge chips, worry about the semiconductor crunch fueled by the pandemic, and are wary of China’s attempts to build a rival indigenous industry. Shared interests have resulted in greater convergence on the screening of foreign direct investment to prevent China’s acquisition of critical technologies, and new initiatives on emerging technologies and supply chain resilience (some as part of the Quad’s activities). But U.S.-Japan coordination is not all smooth-sailing. The allies are not of the same mind regarding the wisdom of decoupling from China. Tokyo worries about the collateral damage of U.S. unilateral tariffs and tech restrictions, and about a weakening industrial base if the U.S. were to pursue total reshoring of semiconductors.

The current subsidy race is not just a response to China’s tech drive; It also reflects competition among partners and allies in their campaigns to lure in and retain the crown jewels of semiconductor manufacturing[13]. As we are about to enter a period of government largesse to support chip manufacturing, broader questions remain about the wisdom of heavily subsidizing an industry with very short product cycles, of making the right bets on the future evolution of the industry, and possibly planting the seeds of future over-capacity problems.

2.Telecom networks and digital connectivity: 5G and Beyond

Mobile communication networks are at the heart of the digital revolution. Fast, reliable, and secure movements of data — as envisioned in the rollout of 5G networks — are critical to a future of autonomous driving vehicles, smart cities, far-reaching cloud services, and military applications such as intelligence, surveillance, and reconnaissance systems (CRS, 2021). Because information is power, as Rush Doshi and Kevin McGuiness (2021) remind us, states have historically cared deeply about their ability to control and manipulate telecom networks at times of strain in the international system. Today, the twin forces of technological transition and state rivalry have brought intense focus on who will dominate cutting-edge mobile communication technologies and with what geopolitical consequences.

The global telecommunication market is highly concentrated, with just three firms (Nokia, Ericsson and Huawei) supplying 80 percent of the 5G base station market[14]. China’s lead in telecom generates acute concerns for the United States and several of its key allies. The Chinese state has long sheltered the ICT sector from trade liberalization commitments and has awarded foreign companies limited access to the Chinese market. Favorable tax breaks and generous subsidies (in some estimates to the tune of 175 billion dollars for 5G infrastructure by 2025[15]) have nurtured tech giants such as telecom equipment providers Huawei and ZTE. With the 2015 launch of the Digital Silk Road (DSR), the Chinese state sprinted to provide the hardware and software of digital infrastructure to a larger swath of the developing world. As Hillman and Sacks (2021) note, China puts together an attractive package that combines funding with the supply of telecom equipment, and a suite of digital technologies (cashless payments, online banking, e-commerce platforms, surveillance know-how, etc.). These efforts are in parallel with an active standard-setting campaign to lock in Chinese tech standards into emerging technologies.

China leads the world in the supply of mobile telecom networks. Since the launch of the Digital Silk Road, Huawei has grown its market share by 40 percent and it has the largest number of 5G contracts worldwide, many of them in Europe (Sacks, 2021). With the adoption of the 2017 National Intelligence Law mandating Chinese tech firms to comply with data sharing requests from the state, the stakes of China’s tech global footprint have grown markedly. From the point of view of the U.S., the China telecom challenge is not just about pushing back against unfair trading practices. Rather, the broader issues of data security and network vulnerability are front and center. Hence, the administration of former U.S. President Donald Trump moved in 2018 to ban Huawei from its 5G mobile communication networks and initiated a campaign to encourage others to follow suit. In 2020, the State Department launched a broader initiative, the Clean Network, to “protect sensitive information from aggressive intrusions by malign actors, such as the Chinese Communist Party[16].”

The American persuasion campaign, however, yielded mixed results as many countries were unconvinced in the absence of a cost-effective alternative to Huawei. Even when allies agreed on the security risks of Chinese telecom, they differed at times on implementation strategy. For instance, the Japanese government tightened the security provisions for public procurement of telecom equipment in December 2018 and required private companies to follow suit in the 2019 spectrum allocation for 5G networks. Japan therefore has bolstered cybersecurity and supply chain resilience in telecom (de facto disqualifying Huawei), without blacklisting specific vendors (Matsubara, 2020). The split on tactics was in full view when Tokyo declined to participate in the Clean Network initiative troubled by its targeting of a specific nation[17].

The United States and Japan are fully aligned, however, in addressing a common vulnerability: their lack of a full stack 5G telecom provider. The United States no longer has firms that manufacture base stations (connecting mobile devices to the core network), and while Japanese companies enjoy competitiveness in specific nodes of the hardware and software supply chain, they do not operate with a vertically integrated platform. Hence, the allies have placed a strategic bet in a reconfiguration of the industry through the Open Radio Access Network or Open RAN. The effort is geared to break vendor lock-in by procuring from multiple suppliers that operate with inter-operable interfaces. Cost-reduction, transparency, and resilience are the expected benefits of the U.S.-Japan decision to pour 4.5 billion dollars into the development of Open RAN standards for 5G and 6G networks[18]. This is not an about-face for Japan. Japanese companies have been frontrunners on multi-vendor interoperability since the rollout of 4G, and more recently Japanese firms NEC and NTT announced a strategic partnership to develop Open RAN infrastructure[19]. Network provider Rakuten has made inroads into 5G with Open RAN and fully virtualized software to reduce costs of physical base stations (Schoff and Kamijima-Tsunoda, 2020).

The United States and Japan see in Open RAN a pathway to hone their own competitive strengths to better meet the China challenge. The success of this enterprise will largely hinge, however, on the ability of cross-vendor open software arrangements to meet exacting network security requirements, and for the specifications to widely disseminate. At this juncture, none of these prospects are assured. The participation of multiple vendors and reliance on open software carries system-wide risks (Griffith, 2020, and Lee-Makiyama, 2020). Open RAN compatible base stations today represent 1 percent of the total (Scott and Kamijima-Tsunoda, 2021: 98). Standard-setting and global alliances among trusted vendors are important undertakings for the U.S-Japan digital partnership, but the trek ahead for the allies will not be an easy climb.

3.International rules and the open digital ecosystem

The explosive growth of the digital economy has far outpaced the development of international rules that can sustain open data flows with due protection for personal information and cyber security. The stakes are high in avoiding the balkanization of the digital ecosystem given the proliferation of disparate regulatory regimes and the spread of digital protectionism. Restrictions on data flows are indeed on the rise. The European Centre for Political Economy’s digital restrictiveness index — looking at scores of policy measures on data policy, market access, and investment conditions — ranks China at the top followed by Russia, India, Indonesia, and Vietnam (Farracane, et al, 2018).

The Chinese state’s zeal to control the digital sphere has been driven by its concerns over internal and external security (i.e. domestic political control and heading off foreign influence). Chinese authorities first erected an internet firewall keeping the likes of Google and Twitter off limits and have implemented strict data localization requirements to stall the overseas transfer of information. As a condition of entry to the Chinese market, foreign firms can be asked to surrender source code and encryption keys. The Chinese state has showered Chinese fintech companies with generous subsidies, but recently it also dramatically tightened its regulatory grip[20].

There are concerns about the growing international influence of Chinese digital authoritarianism, for example, through the export of surveillance technology (Curtis et al, 2021). China’s Data Security Law, which went into effect in September 2021, doubled down on data localization requirements and the state’s access to personal information, and also added two new elements: a ranking of data according to its significance for national security, economic resilience, and the public interest; and the extraterritorial application of Chinese data regulations (with no clarity yet on how this will be implemented)[21].

Notwithstanding the challenges posed by China’s digital illiberalism, a coordinated approach by tech democracies has been hindered by disagreements on how to balance free data flows with safeguards for personal information and cyber security. The European Union has elevated privacy protection to a fundamental human right, and with the 2018 General Data Protection Regulation (GDPR) it restricts the transfer of personal information to countries that maintain similar protection standards. The United States does not have a federal privacy law and has championed the movement of data across borders with privacy and cyber security restrictions commensurate to risk. Japan has also championed free data flows, but with the insistence that trust on safe data transfers is the essential precondition. The Data Free Flow with Trust (DFFT) was a lynchpin for Japan’s 2019 G20 chairmanship and achieving greater regulatory compatibility on privacy regimes to enable unimpeded data flows is a priority of Japan’s diplomacy in other fora. Operationalizing the “trust” variable, however, remains a daunting challenge in the face of divergent national regulatory and philosophical differences, and the high stakes of data access to economic vitality and geopolitical advantage.

Codifying digital trade rules is another key piece to this puzzle. Japan is a co-convener to the e-commerce talks launched in 2019 at the WTO. Nevertheless, quick progress on this front is not expected as distinct cleavages have appeared. Beijing is not willing to relinquish its control over cross-national data transfers, the European Union has insisted on privacy protections on par with GDPR standards, and India and South Africa have questioned the moratorium on duties as they eye it as a significant source of revenue. Of the scores of free trade agreements (FTAs) that contain clauses on e-commerce, only a handful have deeper provisions on data governance (Burri, 2021). Japan and the United States have partnered in the codification of ambitious digital trade rules. The original TPP agreement contained far-reaching provisions banning both data localization (except in financial services) and the release of source code as a condition of market entry; and endorsing the principle of free data flows accompanied by privacy regulatory frameworks by all parties (of their own design).

When the United States walked out of the TPP at the directive of President Trump, Japan was instrumental in the rescue of the agreement (including its digital trade provisions) into the revised Comprehensive and Progressive TPP (CPTPP). A U.S.-Japan digital trade agreement followed in 2019 that built on the original TPP digital toolkit but added new provisions: creating a pathway for data transfers on financial services, banning forced transfers not only of source code but also algorithms and encryption keys, and opening e-access to non-sensitive government data, among others (Holleyman, 2021).

The challenge the United States and Japan confront is not one of misaligned interests in sustaining an open digital ecosystem — the opposite is true. The challenge is that they have not yet been able to leverage their bilateral partnership to achieve broader regional and global impact. The United States has stepped out of ambitious trade negotiations. The Biden administration has yet to give a signal that it is ready to launch a plurilateral digital agreement (building from its agreement with Japan) that could provide economic heft to its Asia policy. Neither Japan nor the United States have acceded to the Digital Economic Partnership Agreement (signed in 2020 by Singapore, Chile and New Zealand) which offers a modular approach to digital trade facilitation and open data flows with privacy protections.

China, however, has stepped up its regional trade diplomacy making formal accession bids to CPTTP and DEPA in quick succession. At first glance, it is hard to understand China’s efforts to join trade agreements that promote open digital flows, while it tightens even further domestic controls over the transfer of data overseas[22]. There is, however, a powerful logic to China’s diplomatic overtures: to ensure that its digital sovereignty practices do not result in its exclusion from the regional architecture; and to shape from the inside the evolution of digital trade governance once membership is achieved. In RCEP, China accepted language on data cross-border flows, but all commitments are exempt from the dispute settlement mechanism and a broad national security exemption applies. Because DEPA also shields from enforcement the commitments on data flows, Chinese accession should not present major hurdles (Asian Trade Centre, 2021). The litmus test will be whether Japan and the other CPTPP countries can prevent a hollowing out of the digital rules as they entertain the Chinese bid.

Conclusion

The digital agenda is a focal point for the United States and Japan as they seek to hone their own strengths, deepen their strategic coordination on the impact of new technologies on advanced manufacturing and telecom platforms, and they work to build resilient supply chains and an open and vibrant digital economy. The domestic investments that each party undertakes to boost innovation, build a digital infrastructure, and especially to nurture human capital and a talent IT pipeline will be critical. So will be the strengthening of cybersecurity given the growing vulnerability of critical infrastructure and communication networks to cyber crimes or state-sponsored attacks. Japan, ranked a tier three cyber power due to its weaker cyber defenses, the lack of national military cyber strategy, and limited cyber resilience with insufficient private sector investment, faces a steeper hill to climb (IISS, 2021).

An emerging U.S.-Japan digital alliance is discernable around three main tracks: tapping on their complementary strengths in the semiconductor supply chain, developing new standards in 5G and beyond that will reduce network vulnerabilities, and offering an alternative to closed digital ecosystems. Potential pitfalls are not hard to spot, however. A subsidy race to onshore large swaths of the semiconductor production chain will do little to cultivate cohesion among the allies or to boost true competitiveness and international influence. Defensive measures to protect critical technologies and infrastructure are necessary, but they do not substitute for a positive economic agenda to craft tech standards and digital trade rules with a wide reach. The United States, in particular, needs to move beyond defensive economic statecraft.

As such, the remit of a U.S.-Japan digital alliance goes beyond reacting to the China challenge. Leadership in the digital domain will require from the United States and Japan a forward-leaning effort to tap on new sources of economic competitiveness, build trust on safe data transfers, and ensure the viability of global supply chains and the sprawling digital economy.

References

- Asian Trade Centre. 2021. “China applies to join DEPA.” November 4th.

- Bown, Chad. 2020. “How the United States marched the semiconductor industry into its trade war with China.” PIIE Working Paper, December.

- Burri, Mira. “Towards a New Treaty on Digital Trade,” Journal of World Trade 55, no. 1 (2021): 77-100.

- Cabinet Office. Council on Economic and Fiscal Policy. “Keizai Zaisei Unei to Kaikaku no Kihon Hoshin 2020 ni Tsuite.” [Basic Policy of Economic and Financial Management and Reform 2020]. July 17, 2020.

- Hoehn, John R. and Kelley M. Sayler. “National Security Implications of Fifth Generation (5G) Mobile Technologies.” Congressional Research Service. June 4, 2021.

- Curtis, Lisa, Joshua Fitt and Jacob Stokes. “Advancing a Liberal Digital Order in the Indo-Pacific.” (Washington, DC: Center for New American Security, May 27, 2021).

- Doshi, Rush and Kevin McGuiness. “Huawei meets history: Great powers and telecommunication risk, 1840-2021.” (Washington, DC: Brookings Institution, March, 2021).

- Duchatel, Mathieu. 2021a. “The Weak Links in China’s Drive for Semiconductors.” Institut Montaigne, Policy Paper. January.

- 2021b. “Racing for the New Rice -Japan’s Plans for Its Semiconductor Industry.” Institut Montaigne, August 4.

- Farracane, Martina Francesca, Hosuk Lee-Makiyama, and Erik van der Marel. 2018. “Digital Trade Restrictiveness Index.” ECIPE.

- Griffith, Melissa K. “Open RAN and 5G: Looking beyond the national security hype.” (Washington, DC: Woodrow Wilson International Center for Scholars, November 2, 2020).

- Harold, Scott W. and Rika Kamijima-Tsunoda. “Winning the 5G Race with China: A U.S.S-Japan Strategy to Trip the Competition, Run Faster, and Put the Fix In.” Asia Policy 16, no. 3 (2021): 75-103.

- Hillman, Jennifer and David Sacks. “China’s Belt and Road: Implications for the United States.” CFR Independent Task Force, no. 79 (Washington, DC: Council on Foreign Relations, 2021).

- Holleyman, Robert. “Data Governance and Trade: The Asia-Pacific Leads the Way.” NBR, January 9, 2021.

- International Institute of Strategic Studies (IISS). 2021. “Cyber Capabilities and National Power: A Net Assessment.” (June 28).

- Irwin, Douglas. “The U.S.-Japan Semiconductor Trade Conflict.” In The Political Economy of Trade Protection, edited by Anne Krueger, 5-14. Chicago: University of Chicago Press, 1996.

- Lee-Makiyama, Hosuk and Florian Forsthuber. “Open RAN: The Technology, its Politics, and Europe’s Response.” ECIPE Policy Brief, no. 8 (Brussels: ECIPE, October 2020).

- Matsubara, Mihoko. “Japan’s 5G Approach Sets a Model for Global Cooperation.” Lawfare, September 14, 2020.

- Ministry of Economy, Trade and Industry. 2021a. “Handôtai Senryaku” [Semiconductor strategy]. June.

- 2021b. “Handôtai, Dejitaru Sangyô Senryaku” [The strategy for semiconductors and digital industry], June.

- Okada, Yoshitaka. “Decline of the Japanese Semiconductor Industry: Institutional Restrictions and the Disintegration of Techno-Governance.” In Struggles for Survival: Institutional and Organizational Changes in Japan’s High-Tech Industries, edited by Yoshitaka Okada. (Tokyo: Springer, 2006), 39-103.

- OECD. “Measuring distortions in international markets: The semiconductor value chain.” OECD Trade Policy Papers, no. 234. (December 12, 2019).

- Plazer, Michaela, John F. Sargent, and Karen M. Sutter. “Semiconductors: U.S. Industry, Global Competition, and Federal Policy.” Congressional Research Service, October 26, 2020.

- Sacks, David. “China’s Huawei is winning the 5G race. Here is what the United States should do to respond?” Council on Foreign Relations, March 21, 2021.

- Schoff, James L. and Rika Kamijima-Tsunoda. “The United States and Japan Should Team Up on 5G.” Carnegie Endowment for International Peace, July 23, 2020.

- Solís, Mireya. “The Big Squeeze: Japanese Supply Chains in the Era of Great Power Competition.” Paper presented at International Studies Association 2021 Annual Convention, virtual, April 2021.

- Sun, Chang, Zhigang Tao, Hongjie Huan, and Hongyong Zhang. “The Impact of the U.S.-China Trade War on Japanese Multinational Corporations.” RIETI Discussion Paper Series 19-e-050. (Tokyo: Research Institute of Economy, Trade and Industry, July 2019).

- White House Taskforce. “Building resilient supply chains, revitalizing American manufacturing, and fostering broad-based growth.” June 2021.

(2021/10/21)

*Click the link below Broolings website

https://www.brookings.edu/research/toward-a-us-japan-digital-alliance/

Notes

- 1 I am grateful to Tsuneo Watanabe, Noboru Yamaguchi, and Chris Meserole for their helpful comments, and to Laura McGhee and Cindy Zheng for their able research assistance. All remaining errors are mine.

- 2 “IMD World Digital Competitiveness Ranking 2020,” (Institute for Management Development, 2020).

- 3 White House, “Fact Sheet: U.S.-Japan Competitiveness and Resilience (CoRe) Partnership,” April 16, 2021.

- 4 Semiconductor Industry Association, “2019 Factbook,” May 21, 2019.

- 5 “Japanese companies fight for share of EUV chip technology sector,” Nikkei Asia, July 12, 2020.

- 6 “Factbox: The high-tech materials at the heart of a Japan-South Korea row,” Reuters, July 2, 2019.

- 7 “China plans $47 billion fund to boost its semiconductor industry.” The Wall Street Journal, May 6, 2018.

- 8 “Toyota, hurt by the chip shortage, will reduce output 40 percent in September,” The New York Times, August 19, 2021.

- 9 Cheng Ting-Fang and Lauly Li, “TSMC halts new Huawei orders after US tightens restrictions,” Nikkei Asia, May 18, 2020.

- 10 The Creating Helpful Incentives to Produce Semiconductors for America Act (CHIPS for short) and the American Foundries Act of 2020 were incorporated into the National Defense Authorization Act of 2021. The latest move was the Senate’s approval of the Innovation and Competition Act on June 2021. A House vote is still pending.

- 11 See.

- 12 See.

- 13 As part of its “Digital Compass,” the EU anticipates spending $150 billion dollars to support high tech manufacturing with the goal of doubling its global production share from 10% to 20% by 2030. See.

- 14 Gearoid Reidy and Ayaka Maki, “Handed a 5G Lifeline by Trump, Japan Races to Catch Up to Huawei,” Bloomberg, December 10, 2020.

- 15 Figure cited in Scott and Kamijima-Tsunoda, (2021: 78).

- 16 “The Clean Network,” U.S. Department of State.

- 17 “Japan told U.S. it won't bar China from telecom networks, report says,” The Japan Times, October 16, 2020.

- 18 White House, “Fact Sheet: U.S.-Japan Competitiveness and Resilience (CoRe) Partnership,” April 16, 2021.

- 19 Scott Foster, “Japan Inc set to challenge Huawei in 5G,” Asia Times, July 10, 2020.

- 20 The regulatory crackdown to eliminate monopolistic practices and reassert state control has affected the Chinese giants Alibaba Group and Tencent as well as rising ride-sharing firm Didi. See. For a broader discussion of how President Xi’s “common prosperity” campaign may redefine relations of the state with society and business see Ryan Hass

- 21 “China Adopts New Data Security Law,” JD Supra, August 4, 2021.

- 22 See.