Contents *Unauthorized reproduction is prohibited

SPF China Observer

HOMENo.30 2020/05/08

COVID-19 and Chinese Economy

Institute of Developing Economies (IDE), JETRO

Chief Senior Researcher Osamu Tanaka

Introduction

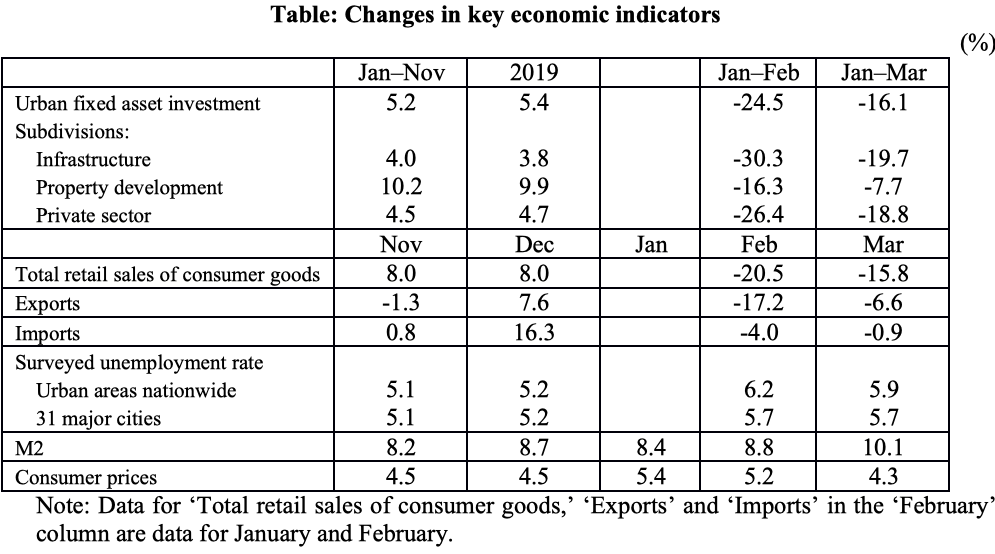

With the significant decline in Chinese economic indicators for January to March due to the spread of pneumonia caused by the novel coronavirus (hereafter “COVID-19”), Chinese macro policies are being largely reviewed. The final macro policies are not yet clear as the National People’s Congress has been postponed and the Government Work Report not released yet. This paper briefs the current economic situation and the ongoing review of macro policies in China, based on the official statistics published by the Chinese government.

1. GDP for January to March 2020

GDP for the first quarter (from January to March) of 2020 showed negative year-on-year growth of -6.8% in real terms. When breaking this down by demand item, contribution to this negative growth was -4.4 percentage points (contribution ratio: 64.7%) for final consumption; -1.4 percentage points (contribution ratio: 20.6%) for capital formation; and -1.0 percentage points (contribution ratio: 14.7%) for net exports.

2. Changes in indicators

(1) Price trends

Consumer price increase in March was less than in February. China’s consumer prices had remained high until last December, mainly driven by a surge in pork prices due to shortage of pork supply caused by African swine fever. In addition to this, consumer prices had continued to rise since January because the COVID-19 outbreak triggered hoarding of food stuff, face masks and other daily necessities by the general public, disruption in the logistics sector, and production stagnation. In response, the national government increased pork imports and local governments released pork reserves, which led to a 6.9% drop in pork prices in March compared to February. Along with the recovery of the distribution system, other food prices including fresh vegetables, fruits, eggs and marine products fell compared to February. Assisted by the declining gasoline prices due to the sluggish petroleum market, consumer inflation is slowing down in general.

(2) Consumption

Total retail sales showed a sharp drop in January and February due to the COVID-19 outbreak, but the decline slowed down in March.

Amongst all consumption items, automobile consumption significantly dropped by 37.0% year-on-year in January and February, when the market was just starting to recover after entering the final phase of market adjustment. In March, however, the drop shrank to -18.1%. Although daily sales in February was below 10,000 units, it recovered to more than 30,000 units in March. In addition to the fact that automobile manufacturers managed to recover their daily production level to over 75% of the same period last year, implementation of a whole suite of government measures has played a large role in driving automobile consumption. For example, local governments relaxed the automobile purchase restrictions and actively provided support for purchasing new automobiles and disposing of old cars. Furthermore, the Ministry of Finance announced a two-year extension of incentive programs such as subsidies for the purchase of new energy vehicles and exemption of automobile purchase tax as well as reduction of value-added tax rates for used vehicle dealers. Automobile consumption accounts for around 10% of total retail sales and around 7% of industrial production, which means the recovery of automobile consumption will have a significant impact on the future trends of consumption and industrial production.

Nationwide online retail sales of physical goods (e-commerce) has been supporting the overall consumption level. It maintained a positive growth of 3.0% even during January and February and further increased to record 5.9% growth for the period of January to March, accounting for 23.6% of the total retail sales of consumer goods in January to March, 5.4 percentage points higher than the same period of the previous year. This is because more consumers chose shopping online over visiting a brick-and-mortar shop due to COVID-19 concerns. In addition, new types of home delivery services which do not involve physical contact now account for 80% of home delivery use cases, demonstrating an update in the e-commerce business model.

(3) Investment

Urban fixed asset investment plunged in January and February due to suspension of ongoing construction projects and delay of new construction starts, reflecting the severe impacts of the COVID-19 outbreak. In the quarter from January to March, however, the magnitude of the drop was reduced by 8.4 percentage points. Among fixed asset investments, infrastructure investment was quick to recover, reducing the drop by 10.6 percentage points compared to January and February. This is largely because the Ministry of Finance has drastically advanced the issuance of special-purpose local government bonds for funding infrastructure development by local governments, issuing 1,104 billion yuan in January to March (compared to 666 billion yuan issued in the same quarter of the previous year). New construction starts for March alone was 11,998, up by 9,497 from January and February together. Similarly, the drop in the total amount of investment for new projects that started construction in January to March improved by 25.1 percentage points compared to the two months of January and February.

As for property development investment, the housing market dropped sharply in January and February because developers refrained from trading and adopted a wait-and-see attitude in response to the COVID-19 outbreak. However, trading resumed in March, and among the 70 larger cities of China, the number of cities in which housing prices rose from the previous month increased from 21 in February to 38 in March. This contributed to mitigating the drop of property development investment by 8.6 percentage points in January to March.

Meanwhile, fixed asset investment by the private sector temporarily showed recovery in December in response to the announcement that the US and China had reached a phase one trade agreement, but returned to a downward trend in January and February due to the COVID-19 outbreak. The decline, however, was mitigated by 7.6 percentage points for the quarter from January to March. Infrastructure investment and property development investment showed particular resilience, whose decline improved by 13.5 percentage points and 8.9 percentage points, respectively.

(4) Foreign demand

As the prospects for the US and China to reach a phase one trade agreement began to look promising since the start of December, both exports and imports were quickly back on the recovery track.

With the outbreak of COVID-19, however, exports and imports returned to negative growth in January and February, and trade deficit was reported due to a plunge in exports. The drop in exports improved in March, and China’s trade balance returned to a surplus for the quarter from January to March but had a negative contribution to the growth rate.

When looking at trade data by partner country/region, the total value of imports and exports with the US, the EU and Japan all marked negative growth for January to March, but trade with ASEAN countries showed a 3.9% growth.

(5) Employment

Despite the slowdown in economy during 2019, the surveyed unemployment rate had remained relatively stable, but it surged in February. This is partly because the movement of people across provincial borders was restricted due to the COVID-19 outbreak, preventing migrant workers from returning to their workplaces after the Lunar New Year period, and on the part of employers, they were cautious about making new hires amid the rapid decline of production and consumption.

In response to this situation, local governments arranged chartered buses and trains to transport migrant workers to provinces that are in need of workforce. As of March, the number of workers who had not returned to work decreased by approximately 60% compared to February, and the average work week of firm employees increased to 44.8 hours in March, up by 4.6 hours from February. This led to an improvement in the surveyed unemployment rate in urban areas for March.

3. Changes in the macro policies post the COVID-19 outbreak

(1) From fighting COVID-19 to prioritizing economy

The focus of COVID-19 response measures taken by the Communist Party Central Committee and the Chinese Government is gradually shifting.

While the spread of COVID-19 was growing more and more serious, China’s initial macro policies were centered on supporting producers of protective clothing, face masks, goggles, and related drugs as well as ensuring supply of daily necessities.

These initial policies were turned when a meeting was held on February 23 for coordinating the prevention and control of COVID-19 and economic and social development, with the attendance of all members of the Central Politburo Standing Committee. It was announced that “macro policy… must be effective enough to offset the impact of the epidemic, in order to prevent the main economic indicators from sliding out of an appropriate range and short-run shocks from turning into long-term trends.” In line with this objective, basic macro policies were shifted to give more emphasis on stabilizing the economy. The wording used for expressing China’s aggressive fiscal policy was changed from “improve quality and efficiency,” decided on in the December 2019 Central Economic Work Conference, to “deliver outcomes more actively,” and likewise expression of the prudent monetary policy was also changed to “further emphasize …flexibility and moderation.”

(2) Development of large-scale economic measures

In response to the deterioration of economic indicators in January and February, the Central Politburo revealed, at its meeting held on March 27 (hereafter “the March 27 meeting”), for the first time that it would introduce large-scale economic measures, noting “the need to promptly develop and set out a comprehensive package of macro policies to actively counter the impact of COVID-19.”

(i) Fiscal policy

As part of its aggressive fiscal policy, it was decided that China would appropriately raise the fiscal deficit ratio to GDP, issue special treasury bonds, and increase the scale of special bonds for local governments. At the same time, various tax cuts and cost reduction measures will be implemented, and the issuance and use of special bonds for local governments will be accelerated to promptly prepare for and advance construction of key projects.

The Standing Committee of the State Council announced at its meeting held on March 31 that the range of projects to be funded by special local government bonds would be expanded beyond conventional target areas to include areas such as important national strategic projects, emergency medical relief, public health, professional training, urban heat and gas supply networks, as well as construction of new types of infrastructure such as facilities to realize 5G, data centers, AI, and IoT.

(ii) Monetary policy

As for the prudent monetary policy, it was noted that China would guide the interest rate to decline in the loan market, maintain reasonable liquidity, defer repayment of loans and interest payment to mitigate difficulties in financing and increased funding costs, and at the same time, ensure accurate financial services to help prevent and control the epidemic, resume business and production, and boost real economy.

Following this announcement, the Standing Committee of the State Council decided at its meeting held on March 31 that the People’s Bank of China (PBOC) would expand the re-lending quota by another 1 trillion yuan to support smaller banks, after the quota had already been increased from 300 billion yuan to 800 billion yuan earlier this year. Together with the 550 billion yuan of liquidity released into the market by the reserve requirement ratio cuts decided on March 15, the 1 trillion yuan will be provided to small and medium-sized banks to ensure comprehensive financial support for small and micro enterprises.

4. Near-term economic policies

When the GDP growth rate for the quarter of January to March came out, General Secretary Xí Jìnpíng convened a Central Politburo meeting on April 17 to analyze the current economic situation and arrange economic policies for the near term. The following is a menu of the large-scale economic measures that have been announced for the time being.

(1) Recognition of the current economic situation

“The situation we experienced in the quarter from January to March this year was extraordinary. COVID-19 suddenly came out of the blue and has brought unprecedented shocks to China’s economic and social development,” stated the meeting, but at the same time, it also highlighted the positive aspects seen in the economy, noting that “social and economic activities are expected to gradually return to normal and the order of production and life is being quickly restored. The Chinese economy is demonstrating extreme resilience, with business operations and production approaching or achieving the normal level. Our efforts to respond to the epidemic are creating many new industries and new business models and promoting their rapid development.”

(2) Basic policy for near-term economic measures

The meeting also stressed the need to “step up” efforts to ensure stability in the “six key areas,” namely, stability in employment, finance, foreign trade, foreign investment, domestic investment, and market expectations, using a stronger expression than “fully implement” used following the March 27 meeting.

In addition, they introduced a new policy of ensuring “six priorities” of employment, people's livelihood, the development of market entities, food and energy security, stable operation of the industrial and supply chains, and smooth functioning at the community level.

Under a situation where COVID-19 has now progressed into an international pandemic and foreign demand cannot be expected to be strong, it was stressed that “China needs to firmly implement strategies to increase domestic demand and uphold economic development and social stability, to ensure the fulfillment of our goal and mission of eradicating poverty, one of the ‘three tough battles’ facing China, and realizing a ‘moderately affluent society’ across the entire country.” On the other hand, the wording of “fulfillment of our goal and mission” that appeared in the March 27 meeting statement was deleted. The goal of realizing a “moderately affluent” society, the cornerstone of which is doubling GDP by 2020 compared with 2010, was thought to be achievable if a growth rate of 5.6% or more could be realized in 2020, as the nominal GDP growth for 2014–2018 was revised upward by 0.1 percentage points in the economic census results announced in November 2019. However, probably because of the sudden drop in GDP growth in January to March caused by the unexpected outbreak of COVID-19, the wording was changed in consideration of the rising uncertainty surrounding the achievement of the goal.

(3) Macro policies

The expressions used in the announcement concerning macro policies were stepped up from the March 27 meeting statement “forceful adjustment and implementation of macro policies” to “need for stronger macro policies to hedge against the impact of the epidemic.”

(i) Fiscal policy

The meeting called for “more proactive fiscal policy to produce more clear-cut results, raise the fiscal deficit ratio to GDP, issue special government bonds to counter the COVID-19 epidemic, increase the issuance of special bonds for local governments, improve the utilization efficiency of capital, and truly play a key role to stabilize the economy.”

Although the March 27 meeting did not give details of the usage of the funding to be obtained by issuing special sovereign bonds, it was made clear that the funding would be allocated to support epidemic response. In addition, the phrase “a key role to stabilize the economy” is a new expression, showing that the government expects fiscal measures to play a key role in stimulating the economy. This maybe one of the reasons why the word “appropriately” was removed from “China will appropriately raise the fiscal deficit ratio to GDP,” a phrase that also appeared in the March 27 meeting statement. The ratio of fiscal deficit to GDP was 2.8% in the FY2019 budget. The Ministry of Finance had aimed to keep this ratio under 3% following the example of EU standards for fiscal soundness. However, the fiscal deficit ratio to GDP is expected to significantly exceed 3% as a result of the planned large-scale economic measures to counter the impact of COVID-19.

(ii) Monetary policy

As for monetary policies, the meeting stressed that “monetary policies should be more flexible and balanced and instruments such as reserve requirement ratio cuts, interest rate reductions and re-lending should be fully leveraged to ensure reasonable and sufficient liquidity and a lower interest rate in the loan market, so that sufficient capital can be channeled into the real economy, especially medium-sized, small and micro enterprises.” Here, we can see that more concrete descriptions of monetary measures and allocation of funding have been added to the statement compared to that of the March 27 meeting.

(4) Increase of domestic demand

The following policy measures were set out based on the recognition that “domestic demand needs to be actively expanded” as foreign demand is suffering from the worldwide pandemic of COVID-19.

(i) Releasing the potential of consumption

Resuming business operations and production, reopening retail stores and markets, stimulating consumer spending, and increasing public consumption

(ii) Active expansion of effective investment

Renovating old and dilapidated residential complexes, strengthening investment in traditional and new infrastructure to advance upgrading of traditional industries, and boosting investment in emerging strategic industries, and mobilizing private sector investment

(iii) Support for selling export products in the domestic market

(iv) Support for medium-sized, small and micro enterprises

Advancing tax and fee cuts and lowering financing and rental costs

(v) Maintaining the stability and competitiveness of the industrial and supply chains

Cooperating within industrial chains to accelerate resumption of business operation and production

(vi) Securing people’s livelihood

Preferentially employing the workforce of poverty areas when resuming business operation and production, and ensuring the full completion of the poverty eradication target on schedule

(vii) Priority sectors and priority groups in the employment policy

Making focused efforts to ensure employment of university graduates

(viii) Social security

Guaranteeing a minimum standard of living and providing temporary inflation subsidies

(ix) Securing agricultural production and steady supply and stable price of important non-staple foods

(x) Pollution control

(xi) Control on the real estate market

Ensuring steady and sound development of the real estate market by maintaining the position that “housings are built to be inhabited, not for speculation”

5. Macro policies for January to March 2020

According to press releases separately published by the Ministry of Finance (April 20), the PBOC (April 10), the China Banking and Insurance Regulatory Commission (April 3), and the Ministry of Human Resources and Social Security (April 21), macro policies that have been adopted since the outbreak of COVID-19 are as follows.

(1) Fiscal policy

(i) Support to fight the epidemic

Funding of 145.2 billion yuan has been arranged by April 19 for epidemic prevention and control, to cover costs related to patient aid and treatment as well as temporary support for healthcare professionals at the frontlines of the fight against COVID-19. Funding will also be used to support interest payments for special loans to key enterprises that produce key medical supplies for epidemic prevention and control.

(ii) Tax cuts, cost reduction

Small and micro enterprises and individual industrial and commercial business operators will have reduction of or exemption from value-added tax; personal income tax to be exempted for income related to epidemic prevention aids and subsidies.

(iii) Reduction of social insurance premiums

Starting from February, the amount of social insurance contributions by enterprises has been reduced by 232.9 billion yuan (218.4 billion yuan for pension insurance, 7.5 billion yuan for unemployment insurance, and 7 billion yuan for worker’s compensation insurance) and the payment term of 28.6 billion yuan has been extended. This, in addition to the reduction of social insurance premiums implemented last year, resulted in a reduction of 129.6 billion yuan in the total of the three social insurance contributions by enterprises nationwide for January to March 2020, compared to the same period of the previous year.

(iv) Central fiscal administration has allocated an accumulative total of 156 billion yuan as subsidies for people in need.

(2) Monetary policy

(i) Support measures totaling 3.3 trillion yuan

This includes 1.75 trillion yuan of long-term funds released into the loan market through three reserve requirement ratio cuts, special re-lending funds of 300 billion yuan, re-lending and re-discount of 500 billion yuan, loan arrangements by policy banks, and temporary deferral of loan repayment and interest payment for medium-sized, small and micro enterprises.

(ii) Increase of loans

The total amount of loans in Renminbi during January to March increased by 7.1 trillion yuan (1.3 trillion yuan increase in terms of growth from the year-earlier period). When looking at the increase of loans by sector, the manufacturing sector increased by 1.1 trillion yuan, the wholesale and retail sector by 0.9 trillion yuan, and infrastructure sector by 1.5 trillion yuan.

(iii) Reduction of interest rates

The average interest rate of general loans was 5.48% in March (0.62 percentage points down from July 2019 before the reform of the loan interest rate system).

(iv) Financing support for medium-sized, small and micro enterprises

In the period from January to March, the Big Five (the five largest state-owned commercial banks) increased comprehensive financial support provided to small and micro enterprises by 240 billion yuan (75 billion yuan increase in terms of growth from the year-earlier period), with an interest rate of 4.3%, 0.3 percentage points down from the annual average of the previous year. Banks increased unsecured loans to enterprises and individual business operators by 2.5 trillion yuan (nearly twice the increase in the year-earlier period), continued existing loans worth 576.8 billion yuan (of which nearly 90% were loans for medium-sized, small and micro enterprises and individual industrial and commercial business operators), and also deferred approximately 880 billion yuan of repayment of loans and interest payment for enterprises. The number of medium-sized, small and micro enterprises who received any such kind of support from financial institutions has exceeded 28 million (around 25% of all medium-sized, small and micro enterprises).

(v) Support to fight the epidemic

Utilizing the funds released by the PBOC’s reserve requirement ratio cuts, re-lending and re-discount, banks are offering special loans at preferential interest rates to enterprises that produce and/or transport key medical supplies and daily commodities.

(vi) Support for stable operation of the industrial and supply chains

From January to March, banks supported industrial chains by providing financing to 218 thousand core enterprises (outstanding balance of 21.4 trillion yuan), 297 thousand upstream enterprises (outstanding balance of 5.8 trillion yuan), and 53 thousand downstream enterprises (outstanding balance of 9.3 trillion yuan).

(vii) Supporting financing through bond and stock investment

From January to March, banks and insurance companies increased bond investment by 2 trillion yuan (of which corporate bonds increased by 360 billion yuan). Insurance funds increased stock investment by 126.3 billion yuan.

(3) Employment

(i) Recruitment of nearly 500 thousand workers for key enterprises that produce key supplies for epidemic prevention and daily necessities

(ii) Transport of nearly 5.9 million migrant workers using chartered buses and trains to help them return to places of work

(iii) Refund of unemployment insurance premiums for stabilizing employment

38.8 billion yuan has been refunded as of April 19 to 3.02 million enterprises.

(iv) Support for business enterprises to hire workers and for workers to start up their own business and secure flexible employment

Employment subsidies totaling nearly 10 billion yuan were paid during January to March.

(v) Support for employment of university graduates

Provided subsidies for employment by medium-sized, small and micro enterprises. Expanded the scale of recruitment by state-owned enterprises and businesses, terminal projects, and the military, and increased the scale of vocational training. Created new jobs for assisting science research and increased the number of teachers and medical jobs. Encouraged university graduates to hunt jobs and/or start businesses that meet service demand from the community.

(vi) Support for employment of migrant workers

Promoted orderly migration and employment. Supported migrant workers to return to agriculture, absorbed them into projects, or helped them start businesses so that they can find jobs in nearby places or their local areas. Created public interest jobs in rural villages to ensure minimum living standards for those really in need.

(vii) Start of online services to support employment, register as being unemployed, and file/accept claims for unemployment insurance

Conclusion

The National People’s Congress will be held on May 22 to deliberate the Government Work Report. Considering China’s moves as outlined above and the scale of economic measures already set out by governments around the world, it can be assumed that the macro policies to be incorporated in the Report will likely involve a major stimulus package comparable to that when the world was hit by the financial crisis following the collapse of the Lehman Brothers.

The large-scale economic measures taken after the financial crisis, however, had serious side effects such as subsequent surge of housing prices, increased debt burden of state-owned enterprises and local governments, production overcapacity, inflation, and increased shadow banking activity.

The housing market has yet to cool down, and the local governments are still competing for higher growth rates by indiscriminately expanding investment. How can the economy be revived while maintaining a healthy and stable macro debt ratio? The Xí Jìnpíng Administration is faced with difficult management of the economy. (The views and opinions contained in this paper are those of the author and do not reflect the views of IDE-JETRO.)

(Dated Apr 30, 2020)