Contents *Unauthorized reproduction is prohibited

SPF China Observer

HOMENo.20 2019/09/5

The Reality of the Chinese economy Based on the Indices

Institute of Developing Economies

TANAKA, Osamu, Chief Senior Researcher

Introduction

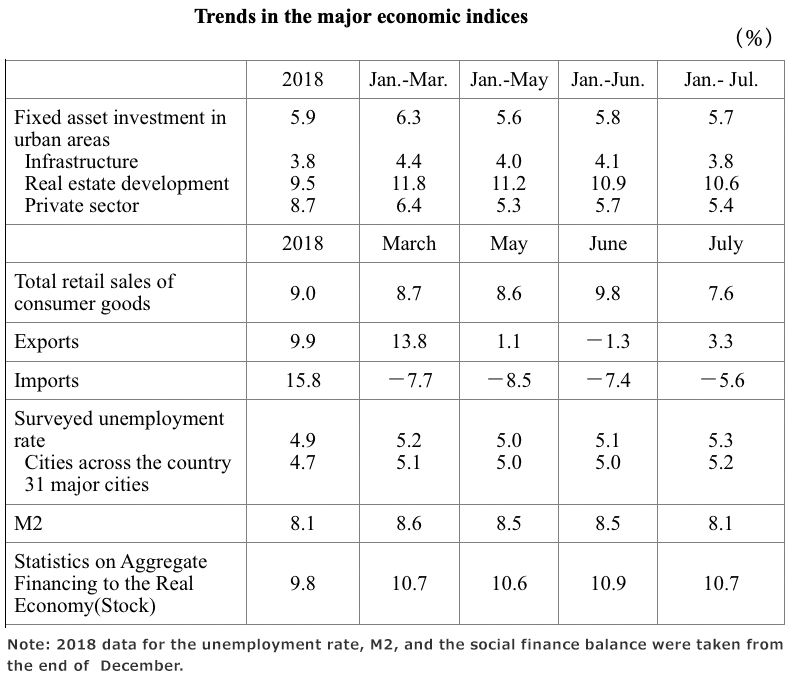

As the China-US trade war and domestic indices have worsened, the downward pressure on the Chinese economy has intensified further. The current article examines the Chinese economy’s current situation based on indices that were published in July this year, including the GDP growth rate for the April to June period, and it reviews policy responses to the second half of the year, which were adopted at the meeting of the Central Politburo of the Communist Party of China on July 30th.

1. GDP

The real GDP growth rate for the January to June period was 6.3%. The quarterly growth was 6.4% for the January to March period and 6.2% for the April to June period. The economic growth rate, which appeared to have stopped slowing down at one point, is once again showing signs of deceleration.

In terms of contribution to the growth rate, as categorized by demand, final consumption contributed 60.1%, capital formation contributed 19.2%, and net export (external demand) contributed 20.7%. Despite the intensification of the China-US trade war, external demand’s contribution has grown substantially. This is because the reduction of imports has continued to surpass that of exports. In 2018, external demand’s contribution was -8.6% because the growth of exports outstripped that of imports.

2. Trends in indices

Let us now review trends in the major economic indices.

(1) Infrastructure investment Since October 2018, economic stimulus in the form of infrastructure investment has been introduced; furthermore, infrastructure investment was moving toward recovery during the January-March 2019 period, as funds were secured by bringing forward special local government bonds issues. However, as a reaction to the front loading, since May, the growth has been sluggish compared to the same period in the previous year.

(2) Real estate development investments

While investments in real estate development have continued to maintain a high growth rate, given this high investment growth rate, the housing market boom is about to peak out.

With regard to the prices of newly built houses in 70 big and medium-sized cities in China in July, compared to the previous month, prices rose in 60 cities, remained the same in seven cities, and fell in three cities. However, in terms of city size, the prices rose by 0.3% (1.3% in December) in the first-tier cities, by 0.7% (0.7% in December) in the second-tier cities, and by 0.7% (0.7% in December) in the third-tier cities; this shows that the rising trend is leveling off.

Furthermore, the area of properties on the market during the January-July period, as compared to the same period in the previous year, was -1.3% (1.3% in 2018), and housing sales showed an increase of 6.2% (12.2% in 2018) compared to the same period in the previous year r r; the area has turned negative, and sales growth has slowed down significantly compared to the previous year. As these housing market trends are gradually being reflected in investments in real estate development, the growth is slowing down.

(3) Private sector investment

Private sector investment growth has been slowing down. As most of this private sector investment is deemed to be capital investment, we can assume that this reflects the effects of the worsening China-US trade war. Many private businesses rely on exports to the US and, given that the future direction of the conflict remains unclear, they are naturally hesitant when it comes to making capital investments, in particular, in manufacturing. Another possible cause is the difficulty of securing funding with regard to finance.

(4) Total consumer goods sales

The growth in consumption has continued to slow down. This growth saw a temporary increase in June, but this was because of the introduction of tougher environmental regulations on vehicles in July, and the retailers rushed to clear their vehicle stock. The size of vehicle consumption in June was 17.2% more than that in the same period in the previous year, but it plummeted to -2.6% in July. According to the National Bureau of Statistics, the growth of total sales, excluding vehicle consumption, was 8.8%.

(5) External demand (net exports)

In contrast to exports, which alternately experience growth and decline, imports are consistently experiencing decline. Ultimately, this sustains the trade surplus and significantly increases external demand’s contribution to the growth rate.

(6) Employment

The number of newly employed persons during the January-July period was 8.67 million; this achieved about 79% of the annual target of 11 million persons. The active opening rate for the April-June period was 1.22 (1.28 for the January-March period).

In contrast, both the national surveyed unemployment rate in urban areas and the surveyed unemployment rate in 31 major cities showed a stabilizing trend leading up to June, but in July, both deteriorated. The National Bureau of Statistics explained this by pointing out that 8.3 million university graduates joined the labor market in July.

However, immediately after the publication of the statistics in July, Premier Li Keqiang held the “round table on policies to stabilize employment for some province” on August 19th and drew attention by stating, “We need to take the rise in the national surveyed unemployment rate very seriously.” This suggests that the government is viewing the issue more seriously.

3.Economic policies for the second half of the year

Following the publication of major economic indices for the January-June period, President Xi Jinping held a meeting for the Central Politburo of the Chinese Communist Party (hereafter, the Meeting) on July 30th in order to analyze and examine the current economic situations and to develop economic policies for the second half of the year. The outline of the Meeting was as follows.

(1) conomic situation assessment

While the President appreciated that “the economic management of the first half of the year has maintained the developmental mode of ‘being calm on the whole and showing progress in stability,”’ he stated that “our country’s economic development today is facing new risks and challenges with the growing downward pressure on the domestic economy. We need to strengthen our sense of concern, to grasp the long-term trends, to firmly comprehend major contradictions, to deftly convert crises into chances, and to seriously grapple with our own affairs.”

According to commentary by the Beijing version of the XINHUA News Agency on July 30th, 2019, “our own affairs” refers to a) making efforts with regard to reform and opening-up and b) placing emphasis on guaranteeing and improving the welfare of the people, such as in housing and employment.

(2) Basic economic policies for the second half of the year

The Meeting confirmed that “economic policies for the second half of the year carry serious significance” and pointed out the necessity of encouraging sustainable and healthy development for the economy by undertaking joined-up planning for the two major dimensions, domestic and international, by drafting solid policies for stable growth, promotion of reform, structural adjustment, prioritization of the welfare of the people, prevention of risks, and maintenance of stability, and by meticulously implementing “six stability” policies consisting of “the stabilization of employment, finance, external trade, foreign investment, investment, and prediction.”

(3) Macro policies

① Fiscal policies

Regarding proactive fiscal policies, the Meeting emphasized the need to “increase oits power and improve its efficiency and to continue implementing tax cut and cost reduction policies in detail.”

As for what “in detail” implies here, according to a report delivered by Liu Kun, Minister of Finance, at the Standing Committee of the National People’s Congress on August 23rd, it means to pay close attention to changes in the tax burden of each industry and “to ensure that the tax burden of major industries, such as manufacturing, will go down significantly, to ensure that the tax burden will go down to a certain extent in the construction and the transport/haulage industries, to ensure that the tax burden on other industries will not increase and, instead, only decrease, and to effectively lower social security contributions by businesses, in particular, small and very small businesses.” In addition, the report stated that, if local governments modified the policy by changing the forms of cost in order to cancel the tax cut effects, they would be investigated and punished as soon as such instances come to light.

In other words, the tax cut and cost reduction policies, as seen in the VAT cut in April and the cut in employers’ contributions to urban employees’ basic pensions in May, are still being implemented, and their effects are yet to be determined. Because the cost reduction policies will lead to a reduction in the local government’s revenue, passive resistance is being expected, and strict monitoring of the central government’s implementation is necessary.

② Monetary policies

Regarding moderate monetary policies, the Meeting used the conventional wording that “monetary policies should be appropriately eased and tightened in order to maintain a rational sufficiency of liquidity.”

In addition, the Meeting stated that “we will promote structural reform for the monetary supply side, guide financial institutions to increase mid- and long-term loans to manufacturing and private businesses, achieve a firm grasp on the speed and degree of risk handling, and ensure that financial institutions, the local government, and financial supervisory authorities take responsibility.”

The special mention of manufacturing suggests that securing capital investment in manufacturing, especially with regard to private manufacturing businesses, is becoming difficult. This is likely to be linked to the decline in investments in the private sector. In addition, at the “video conference on second half-yearly policies” held by the People’s Bank on August 2nd, it was suggested that the serious credit risk of Baoshang Bank and liquidity risks of some medium and small financial institutions were being handled appropriately. The reference to risk handling therefore reflects this.

③ Employment policies

Regarding employment policies, the Meeting continued to use conventional wording: “we are carrying out solid employment policies for the focus groups, such as university graduates, migrant workers from rural areas, and retired military personnel.”

However, at the aforementioned “round table on policies to stabilize employment in some province ” held on August 19th, Premier Li Keqiang emphasized that “we need to strengthen the stability of business management and employees’ posts, and we need to support, in particular, labor intensive firms and businesses that are facing temporary management difficulties so that they can overcome the difficulties.”

Furthermore, it was stated that skills improvement for employees and training for job and industry changes would be implemented using 100 billion yuan from the unemployment insurance fund, that the number of places in the higher job training schools would be increased by a million, and that the number of places in technical worker training schools located in 200 places across the country would be increased in order to strengthen policies to prevent the emergence of unemployment.

④ Housing policies

The area of focus indicates a clear rejection of economic boosting policies based on real estate, as seen in “we firmly maintain the position that ‘housing is for living in and not for speculation,’ implement a management mechanism of real estate, which is effective in the long term, and disavow real estate as a means of creating temporary economic stimulus.”

As the active real estate market expands the industrial production of steel, cement, aluminum, and glass; construction consumption, interior decoration, furniture, household electrical appliances, and acoustic products; and investments in real estate development, it is often used as an economic stimulus, and minor overheating of the market has been ignored. However, because appreciation in housing prices increases the household’s mortgage burden and increases debt risks and constraints on consumption, this time, the long-term, healthy development of the real estate market has been prioritized.

⑤ Consumption and investment

It was stated that consumption should reflect actions “to dig deep for latent domestic demand, to develop and expand final demand, to kick start the rural market effectively, and to increase consumption by using many of the reform measures.” According to the National Development and Reform Commission’s report to the Standing Committee of the National People’s Congress, which was delivered on August 23rd, emphasis was placed on promoting the discarding and replacing of old vehicles as well as the development of the rural market and new fields, including elderly care, infant education, and household chores support.

As for investment, the Meeting narrowed down the objectives as follows: “to stabilize investment in manufacturing, to implement the redevelopment of old collective housing in urban areas and projects that reinforce weak parts, such as parking space, in urban areas and cold chain distribution facilities between cities and rural areas, and to urgently promote the construction of new types of infrastructure such as the information network.”

Conclusion

As we have seen, the Party and the State Council are cautious about implementing additional economic stimulus measures at the moment, and with regard to macro policies, they consider it important to properly implement the policies set out in the “government’s activity report” in March. This is probably because the Xi Jinping leadership faces the contradictory challenges of stabilizing economic growth and preventing and resolving the financial risks.

However, the fourth US customs sanction, which came into effect in September, included labor intensive products such as clothing, shoes, and toys. If businesses exporting to the US start to find the situation even more difficult and the employment indices continue to worsen, the leadership will have to adopt economic stimulus measures keeping in mind the seventieth anniversary of the Founding of the Republic and the fourth plenary meeting of the Central Committee of the Communist Party of China in October. In this respect, the economic trends of September and October are important for figuring out future economic policies.

(Dated Sep 3, 2019)