EVENT REPORT -How public market applies a gender lens to increase the flow of capital to gender equality

October 13, 2021

Gender lens investing (GLI) is an investment that intentionally focuses on the gender factors and makes investment decisions with the aim of improving not only financial returns but also getting better business, social, and environmental outcomes. It is a concept that is spreading worldwide as a key to gender equality, a common social issue faced not just by Japan but also the rest of the world.

The Gender Investment and Innovation Department at the Sasakawa Peace Foundation (SPF) held a breakout session entitled “Counting women to valuing women - How public market applies a gender lens to increase the flow of capital to gender equality” on September 28, 2021, as part of the "Impact Investing Forum 2021" hosted by the Global Steering Group for Impact Investment (GSG) Advisory Committee in Japan. In this session, SPF invited three experts to discuss the key trends of GLI in the public market, and the significance and potential of investment to create “gender impact” in Japan.

Itsu Adachi, Executive Director at SPF, kicked off the session, introducing the "Asia Women's Impact Fund (AWIF)" established by SPF to promote women's economic empowerment through GLI. He emphasized the idea that GLI is "not just the right investment, but the smart investment."

Next, Julia Enyart, Vice President of the Sustainable and Impact Investment Department at Glenmede Investment Management, an independently owned boutique asset management company with USD 40 billion in assets under management, introduced a report that the firm released last year, entitled, "Gender Lens Investing in Public Markets: It's More Than Women at the Top.” In the report, Glenmede Investment Management explores the next frontier of GLI, with a focus on identifying five dimensions (women in leadership, access to benefits, pay equity, diverse supply chains, and talent and culture) that prove how investing in women pays off. Among its findings, she emphasized the correlation between gender equity and corporate performance, which showed that companies with gender-diverse leadership demonstrate lower risk and higher sales growth, EPS growth, and return on assets. In addition, she raised that there is a global trend among investors moving toward investment strategies that they pay attention not only in companies with many women in managerial positions, but also look at qualitative aspects, and that going forward, investors need to continue to pay more attention to more granular corporate features, including not just diversified leadership but also to these five dimensions to achieve social outcomes as well as financial outcomes.

Next, Patience Marime-Ball, Chief Executive Officer at the Women of the World Endowment, stated that investing with gender lens by shifting financial systems to fully include them is our opportunity to build a sustainable future for humanity, and emphasized the importance of ESG investment (*) and gender impact investment, sharing cases on the effects of gender diversity on corporate performance as well as examples of private funds having good gender balance that outperformed their peers in annual returns. She also presented how Women of the World Endowment invests at the intersection of gender and other social issues with an aim to enable a positive impact in the lives of women, girls and their communities. She shared practical information on tools and platforms, such as Ethos, which provides scoring for investments on key impact areas such as gender equality, racial justice, climate change, etc. She also explained the opportunities in the Japanese market, using stocks, bonds, sovereigns and sub-sovereigns as examples.

*ESG investment: A type of investment that considers not just the financial information, but also the environmental (E), social (S), and governance (G) impacts in assessing returns.

In the last presentation, Seiichiro Uchi, Head of Self-Index and ESG Business Development Investment Solutions at Invesco Asset Management (Japan) Limited, reviewed the situation of GLI in Japan. He first mentioned key milestones such as the selection of diversity-themed indices for ESG investment by the Government Pension Investment Fund (GPIF) in 2017 that provided momentum in advancing the concept of GLI, although the spread of GLI vehicles remains rather limited. Mr. Uchi explained how changes have been made in Japan through GLI since the GPIF's selection of diversity-themed indices for ESG investment in 2017, by showing several key data, such as how the number of companies with more than one female director increased from 40% to 72%. However, he said that in Japan, the proportion of women in managerial positions is still extremely low, and that companies without a comprehensive gender equity mandate may be exposed to unexpected risks and missed opportunities for long-term growth, and lack of gender equality and diversity is a systemic risk. Furthermore, in order to make changes, he mentioned it may also be necessary to utilize greater social power beyond the power of investment to solve such complex problems relating to the economy and society. Lastly, he mentioned the change that investors' interests are shifting from returns to returns + impacts, and emphasized that companies need to also move toward their ESG and impact purpose and enhance enterprise values.

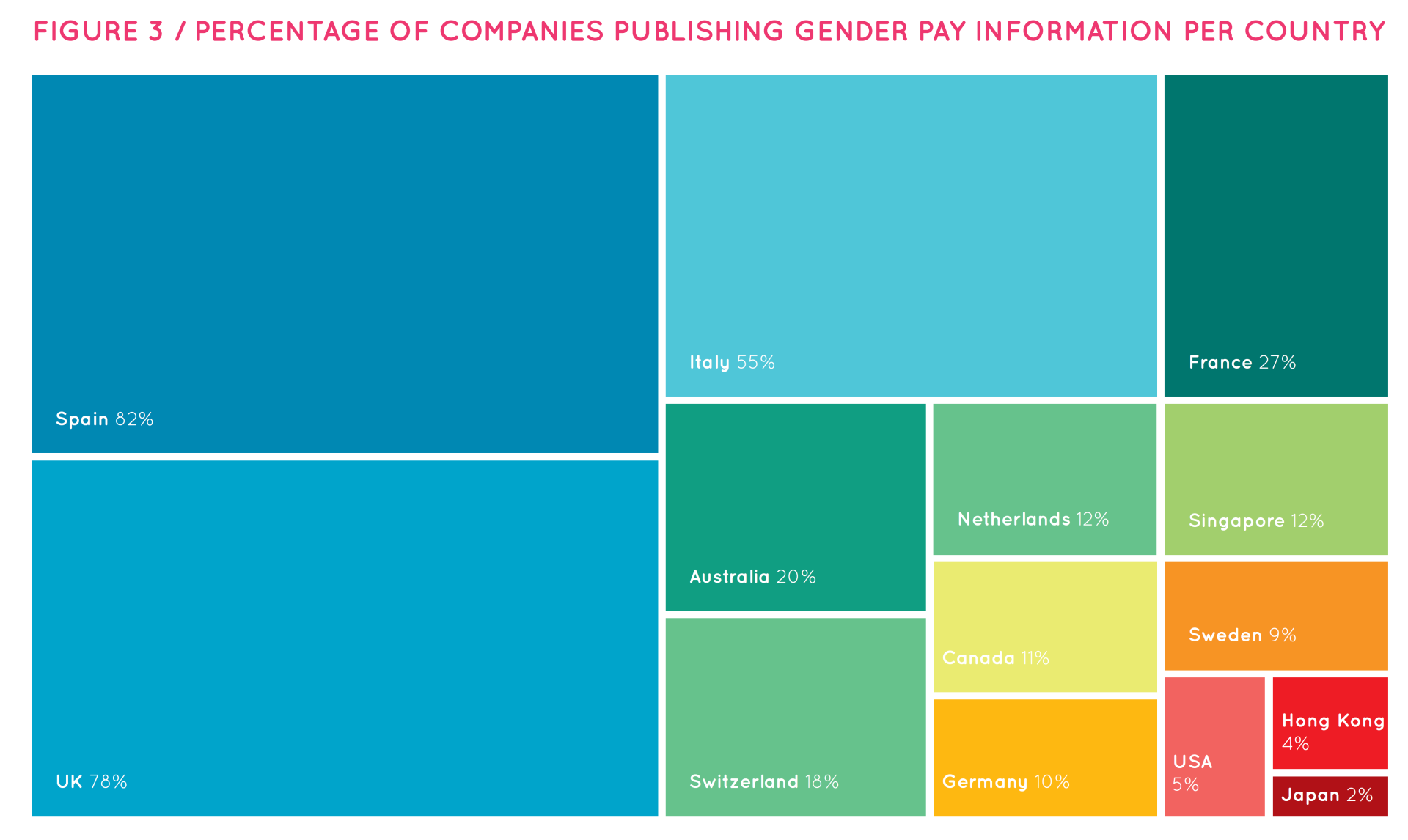

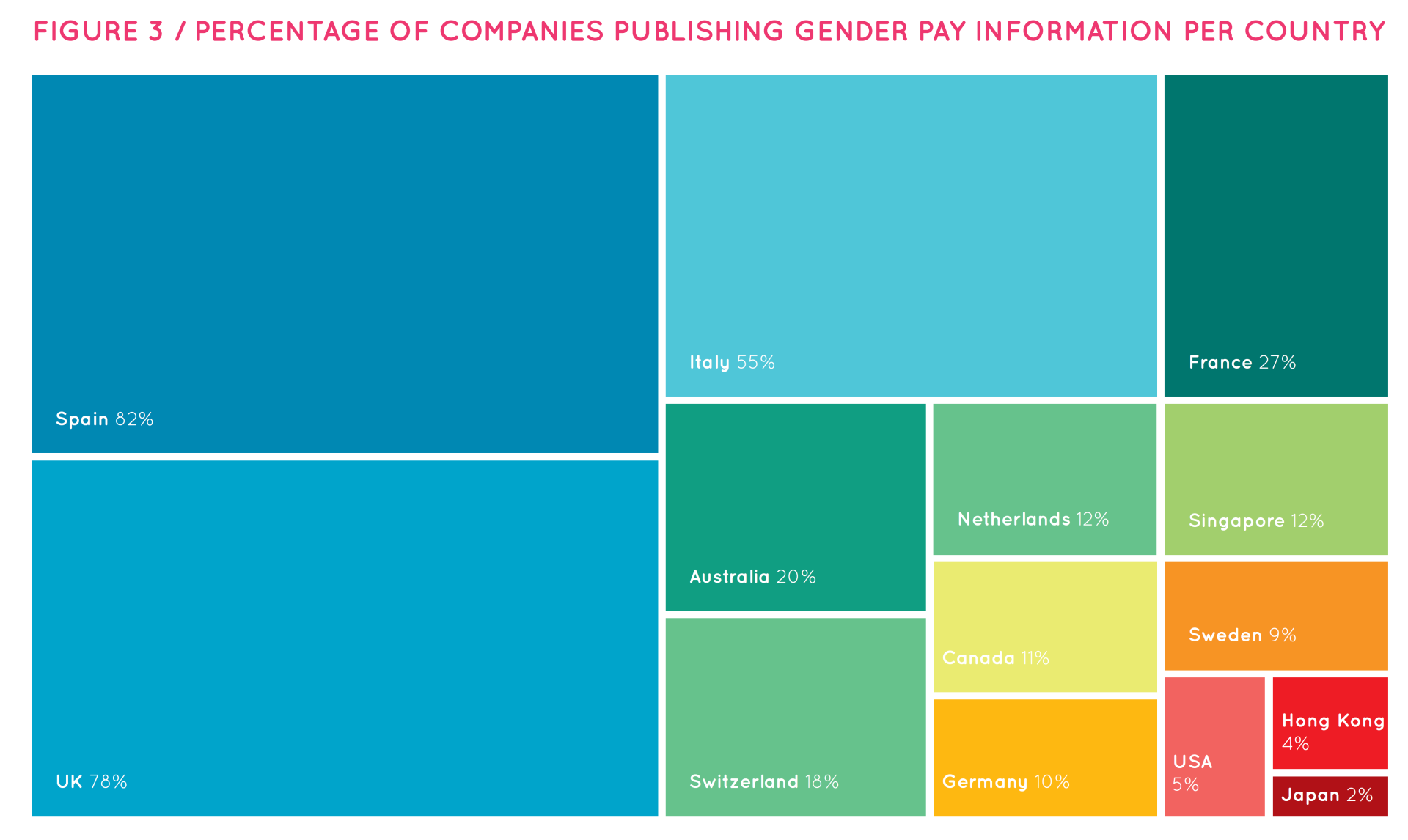

In the panel discussion session moderated by Mr. Adachi, Ms. Enyart first answered questions on how progress and changes have been made on quantitative information disclosure given the larger number of GLI vehicles in North America. She mentioned that women began to speak out problems such as sexual harassment in the workplace and various industries, and that the need to promote gender equality in the workplace became a common recognition, which helped to disclose important information which led to the creation of more GLI vehicles. In order to foster the field of GLI to mature more in the public market, she said that it is necessary for public companies to disclose data across the five dimensions of gender equity (women in leadership, access to benefits, pay equity, diverse supply chains, and talent and culture) by saying a more robust dataset may help identify factors for companies which can mitigate risk and drive long-term growth and progress toward true gender equity in the workplace. Regarding the hindrance of gender lens investment growth, she pointed out that data availability remains sparse, which is tied to the limited availability of GLI investment vehicles. (See figure below)

(Source) Equileap 2021 Global Report

Next, Mr. Uchi shared his view on the reasons behind the slow adoption of GLI concept in Japan. He said that gender issues are complex and includes mixed determiants of social structural issues and issues of gender inequality at each corporate level. Mr. Uchi explained the importance of diversity by showing the data of how it would boost a company’s overall performance. However, he stated the idea that Japanese companies tend not to think of gender issues as their own issues nor a risk, but rather consider them as greater issues within society as a whole, and pointed out that this mind-set is what sets back diversity and inclusion initiatives at the individual companies. He also argued that while social movements and shareholder pressure will keep playing their roles to trigger this much needed change, regulatory changes such as requiring companies to take on gender equity initiatives and to disclose ESG and impact data. He mentioned that while GLI can lead the way, it is also necessary to take collective action in order to make changes to the status quo.

In this regard, Ms. Marime-Ball echoed that being gender smart in the investment process and decisions can lead to many possibilities including creating better business performance through embracing diversity, better fund management and revenue generation, and more sustainable portfolio building. She also mentioned the importance of considering the “intersectionality” of GLI (Note: an approach that analyzes, understands and responds to the intersection of gender and other inequalities), as there are greater possibilities to bring synergy in solving various social issues and creating social change. Continuing on this topic, Mr. Adachi referred to the report entitled "Gender Diversity and Climate Innovation" released by Bloomberg NEF and the SPF, which showed the correlation between the promotion of gender equality in companies with efforts to address climate change and promotion of innovation.

In addition, Ms. Marime-Ball mentioned the need to get asset owners to utilize both financial and strategic capital to revitalize the flow of capital relating to solving gender issues in Japan. Specifically, she mentioned the overall cycle of data aggregation and analysis, translation of such data and analysis into investable strategies and products, seeding of new strategies with risk-adjusted returns and social impact, growing these SMAs, investing in the syndication of SMA strategies to the broader market, using convening power to develop standards, metrics, and frameworks, and to use strategic capital to influence other asset owners to look at impact when making decisions, and concluded that repetition of this cycle is key in making a greater influence.

In closing the session, Mr. Adachi stated that he would like to continue the discussions on GLI and collaborate with other partners in the efforts to take further concrete actions to solve these issues.

The Gender Investment and Innovation Department at the Sasakawa Peace Foundation (SPF) held a breakout session entitled “Counting women to valuing women - How public market applies a gender lens to increase the flow of capital to gender equality” on September 28, 2021, as part of the "Impact Investing Forum 2021" hosted by the Global Steering Group for Impact Investment (GSG) Advisory Committee in Japan. In this session, SPF invited three experts to discuss the key trends of GLI in the public market, and the significance and potential of investment to create “gender impact” in Japan.

Itsu Adachi, Executive Director at SPF, kicked off the session, introducing the "Asia Women's Impact Fund (AWIF)" established by SPF to promote women's economic empowerment through GLI. He emphasized the idea that GLI is "not just the right investment, but the smart investment."

Next, Julia Enyart, Vice President of the Sustainable and Impact Investment Department at Glenmede Investment Management, an independently owned boutique asset management company with USD 40 billion in assets under management, introduced a report that the firm released last year, entitled, "Gender Lens Investing in Public Markets: It's More Than Women at the Top.” In the report, Glenmede Investment Management explores the next frontier of GLI, with a focus on identifying five dimensions (women in leadership, access to benefits, pay equity, diverse supply chains, and talent and culture) that prove how investing in women pays off. Among its findings, she emphasized the correlation between gender equity and corporate performance, which showed that companies with gender-diverse leadership demonstrate lower risk and higher sales growth, EPS growth, and return on assets. In addition, she raised that there is a global trend among investors moving toward investment strategies that they pay attention not only in companies with many women in managerial positions, but also look at qualitative aspects, and that going forward, investors need to continue to pay more attention to more granular corporate features, including not just diversified leadership but also to these five dimensions to achieve social outcomes as well as financial outcomes.

Next, Patience Marime-Ball, Chief Executive Officer at the Women of the World Endowment, stated that investing with gender lens by shifting financial systems to fully include them is our opportunity to build a sustainable future for humanity, and emphasized the importance of ESG investment (*) and gender impact investment, sharing cases on the effects of gender diversity on corporate performance as well as examples of private funds having good gender balance that outperformed their peers in annual returns. She also presented how Women of the World Endowment invests at the intersection of gender and other social issues with an aim to enable a positive impact in the lives of women, girls and their communities. She shared practical information on tools and platforms, such as Ethos, which provides scoring for investments on key impact areas such as gender equality, racial justice, climate change, etc. She also explained the opportunities in the Japanese market, using stocks, bonds, sovereigns and sub-sovereigns as examples.

*ESG investment: A type of investment that considers not just the financial information, but also the environmental (E), social (S), and governance (G) impacts in assessing returns.

In the last presentation, Seiichiro Uchi, Head of Self-Index and ESG Business Development Investment Solutions at Invesco Asset Management (Japan) Limited, reviewed the situation of GLI in Japan. He first mentioned key milestones such as the selection of diversity-themed indices for ESG investment by the Government Pension Investment Fund (GPIF) in 2017 that provided momentum in advancing the concept of GLI, although the spread of GLI vehicles remains rather limited. Mr. Uchi explained how changes have been made in Japan through GLI since the GPIF's selection of diversity-themed indices for ESG investment in 2017, by showing several key data, such as how the number of companies with more than one female director increased from 40% to 72%. However, he said that in Japan, the proportion of women in managerial positions is still extremely low, and that companies without a comprehensive gender equity mandate may be exposed to unexpected risks and missed opportunities for long-term growth, and lack of gender equality and diversity is a systemic risk. Furthermore, in order to make changes, he mentioned it may also be necessary to utilize greater social power beyond the power of investment to solve such complex problems relating to the economy and society. Lastly, he mentioned the change that investors' interests are shifting from returns to returns + impacts, and emphasized that companies need to also move toward their ESG and impact purpose and enhance enterprise values.

In the panel discussion session moderated by Mr. Adachi, Ms. Enyart first answered questions on how progress and changes have been made on quantitative information disclosure given the larger number of GLI vehicles in North America. She mentioned that women began to speak out problems such as sexual harassment in the workplace and various industries, and that the need to promote gender equality in the workplace became a common recognition, which helped to disclose important information which led to the creation of more GLI vehicles. In order to foster the field of GLI to mature more in the public market, she said that it is necessary for public companies to disclose data across the five dimensions of gender equity (women in leadership, access to benefits, pay equity, diverse supply chains, and talent and culture) by saying a more robust dataset may help identify factors for companies which can mitigate risk and drive long-term growth and progress toward true gender equity in the workplace. Regarding the hindrance of gender lens investment growth, she pointed out that data availability remains sparse, which is tied to the limited availability of GLI investment vehicles. (See figure below)

(Source) Equileap 2021 Global Report

Next, Mr. Uchi shared his view on the reasons behind the slow adoption of GLI concept in Japan. He said that gender issues are complex and includes mixed determiants of social structural issues and issues of gender inequality at each corporate level. Mr. Uchi explained the importance of diversity by showing the data of how it would boost a company’s overall performance. However, he stated the idea that Japanese companies tend not to think of gender issues as their own issues nor a risk, but rather consider them as greater issues within society as a whole, and pointed out that this mind-set is what sets back diversity and inclusion initiatives at the individual companies. He also argued that while social movements and shareholder pressure will keep playing their roles to trigger this much needed change, regulatory changes such as requiring companies to take on gender equity initiatives and to disclose ESG and impact data. He mentioned that while GLI can lead the way, it is also necessary to take collective action in order to make changes to the status quo.

In this regard, Ms. Marime-Ball echoed that being gender smart in the investment process and decisions can lead to many possibilities including creating better business performance through embracing diversity, better fund management and revenue generation, and more sustainable portfolio building. She also mentioned the importance of considering the “intersectionality” of GLI (Note: an approach that analyzes, understands and responds to the intersection of gender and other inequalities), as there are greater possibilities to bring synergy in solving various social issues and creating social change. Continuing on this topic, Mr. Adachi referred to the report entitled "Gender Diversity and Climate Innovation" released by Bloomberg NEF and the SPF, which showed the correlation between the promotion of gender equality in companies with efforts to address climate change and promotion of innovation.

In addition, Ms. Marime-Ball mentioned the need to get asset owners to utilize both financial and strategic capital to revitalize the flow of capital relating to solving gender issues in Japan. Specifically, she mentioned the overall cycle of data aggregation and analysis, translation of such data and analysis into investable strategies and products, seeding of new strategies with risk-adjusted returns and social impact, growing these SMAs, investing in the syndication of SMA strategies to the broader market, using convening power to develop standards, metrics, and frameworks, and to use strategic capital to influence other asset owners to look at impact when making decisions, and concluded that repetition of this cycle is key in making a greater influence.

In closing the session, Mr. Adachi stated that he would like to continue the discussions on GLI and collaborate with other partners in the efforts to take further concrete actions to solve these issues.

BE A

DRIVING FORCE

FOR WOMEN

Collective action has the power to accelerate the advancement of women’s economic empowerment and gender equality across Asia. We are actively seeking innovative solutions and models, knowledge sharing opportunities and partnerships with like-minded leaders.

Please contact us at awif@spf.or.jp to learn more and explore opportunities.